Online and Mobile Experience Enhancements - Commercial

A new mobile app and online banking experience.

We're committed to you and to making this process as easy as it can be for you. You’ll have access to a broader range of functionality on both our mobile app and online banking. Our goal is to provide you additional tools to manage your cash flow, optimize efficiencies, and enrich your digital banking experience. We are here to help your business prosper.

Important

Remember to check your email. It’s our principal communication channel for the details of your transition.

Things to know

This hub is your resource center from now until your new online and mobile experience launches. Here, you'll find key actions to take, details about the launch, FAQs, guides, videos and more. Review the tabs below.

We will be sending you additional information as we get closer to an enhanced digital banking experience. Reference your email. The switch will happen over a weekend, and there will be a maintenance window during which you will have a few limitations within your app and online banking.

Just a reminder, if you get an unexpected call, text, or email asking for personal or financial account information, protect yourself by hanging up or deleting the text or email without responding. Call our Customer Care team to be sure you are speaking with First Merchants.

Reminder for managing and updating user profiles.

- Remove inactive users, ACH and wire templates if applicable.

- Make sure your phone number and email address are up to date. It's important for you to prepare and continue to have access to your accounts.

It is easy to update or verify your contact information.

For Administrators to update user email and phone details:

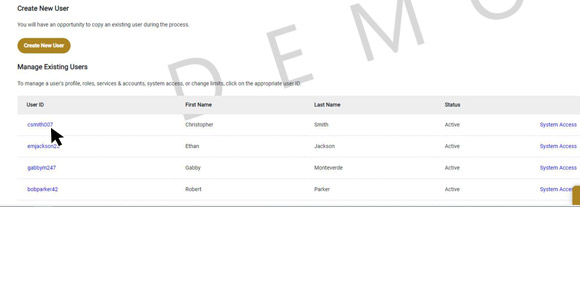

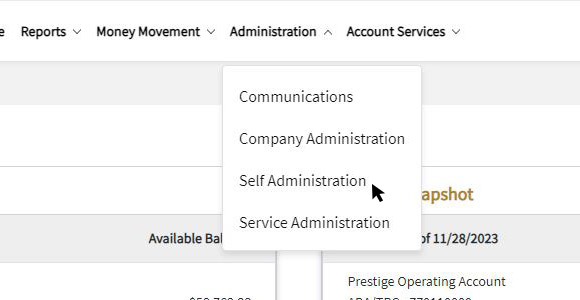

From the navigation, click Administration > Company Administration

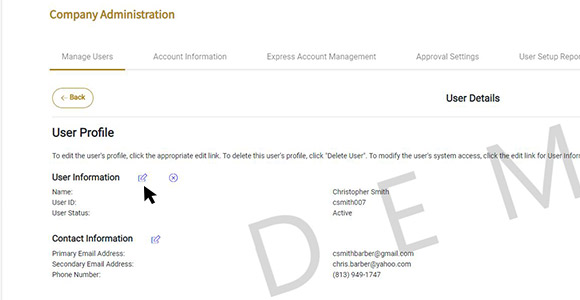

Under Manage Existing Users, select the user ID for the user that needs updated.

Click the edit icon next to User Information

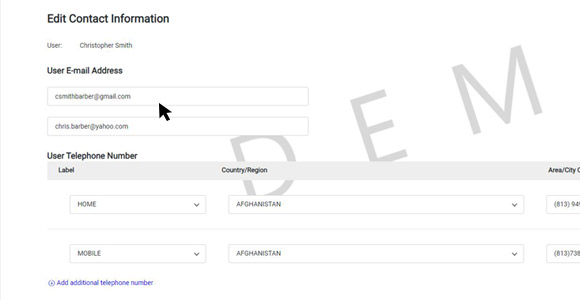

Add or edit an email address

Under User Email Address, you can add or edit the primary and secondary email address by clicking into the input field.

Add a phone number

Under User Telephone Number, click the blue text to add an additional telephone number.

Click Save when edits are completed.

Remove a phone number

Under User Telephone Number, click the X icon next to the extension input field.

Click Save when edits are completed.

For Users to edit their own email and phone details:

From the navigation, click Administration > Self Administration

Under Self Administration, select the Personal Preferences tab.

In the email section, click the blue edit icon to edit the existing email address.

Click the blue plus icon and text to add an email address.

Once you have updated the email field, click add to save.

Edit a phone number

Under the Telephone Section, click the blue edit icon to edit the existing phone number.

Remove a phone number

Under the Telephone Section, click the red x to the right of the phone number you want to remove.

Now that you have made sure your contact information, users, and templates are up to date, it is time to think about the historical data for your account. Make sure to save any information your team may need to refer to later. Details are below. For clients that have not yet migrated to the new solution, you can continue to access your User Guides for Mobile and Online Banking here. If you have migrated and currently have access to the new solution, view your User Guides for Mobile and Online Banking here.

Download necessary account history, reports, alerts, secure messages, and QuickBooks transactions for future reference.

- Make note of current user entitlements and profile configurations. This will help you verify entitlements in the new solution.

- Account History: You will have access to account history as of August 17, 2023 when you log into the new solution.

- Download or print your custom alert settings, saved reports, and scheduled reports. On the first day, you will need to reestablish your customized alerts and reports.

- Positive Pay: If you have the Positive Pay service, review current alerts and history of decisions, should you need to refer back to these. You currently have access to 7 days of decision history. At launch of the new solution, you will have 3 days of decision history, which will build up to 90 days of history going forward.

For clients that have not yet migrated to the new solution, you can continue to access your User Guides for Mobile and Online Banking here.

Looking for specific topic support for the new solution? View our helpful user guides and how to videos:

User Guides

- QuickBooks User Guide

- Alerts User Guide

- Account Labels User Guide

- Account Reporting User Guide

- Account Statement User Guide

- Account Transfers

- ACH Payments User Guide

- Activity Center

- Bill Pay User Guide

- Check Services

- Dashboard

- Information Reporting

- Loan Payments

- Log In User Guide

- Multiple-Account Transfers

- Positive Pay User Guide

- Recipient Management

- User Management User Guide

- User Role Management User Guide

- Wire Payments

Training on Demand

Videos

Our clients will get access to the new mobile app and online banking solution on different dates.

If we have not yet let you know your specific transition date, the details in each date below will not apply to you at tis time. We will send you details as we get closer to your enhanced digital banking experience.

Is your solution launch date:

May 6th - Click here for your information

May 20th - Click here for your information

June 24th - Click here for your information

July 15th - Click here for your information

July 29th - Click here for your information

Is It Time?

Our clients will get access to the new mobile app and online banking solution on different dates.

If you do not yet have access, the information below will not apply to you at this time. We will send you details as we get closer to your enhanced digital banking experience.

Here Now

Did you receive your login instructions and are you now in the new solution? Here is the information you need to know. Click here for information.

FAQs

Desktop and mobile access

Yes. There is one FMB Banking mobile app that services both commercial and personal accounts. If you are not seeing the accounts you are trying to access, make sure you are using the appropriate credentials. You may need to log out and log back in with your other username and password.

Yes. You will need to uninstall the existing First Merchants mobile app from your mobile device and download the new FMB Banking app. We will send you details on when the new mobile app is ready for you to download.

Yes. The administrator will be identified with ADMIN as the role assigned to them in their profile. For instance, Jane Smith-ADMIN.

Managing accounts, transfers, and payments

Yes. Click here to find step by steps instructions for reconnecting QuickBooks.

Service and support.

You will find several self-service resources such as how-to videos and user guides on our website. For additional assistance, contact our Customer Care team at1.800.205.3464.