First Merchants Private Wealth Advisors

Gain vision and strategic insights to help you prosper in the year ahead.

Private Wealth Advisors Mission: Attentively Helping You Prosper

We partner with individuals, families and organizations to attentively provide comprehensive solutions and personal service in pursuit of a secure financial future.

We do this through:

Powerful Local Resources

Delivering broad advisory capabilities through local, engaged, and empowered leaders.

Comprehensive & Coordinated Approach

Surrounding our clients with a team of experts to deliver financial solutions focused on their long-term financial success.

Standard of Excellence

Delivering proactive service and client advocacy as we look to build powerful, intergenerational relationships. Our team of wealth managers, portfolio managers, private bankers and wealth advisors will conscientiously work with you to determine your goals and help you achieve them. We deliver expertise across multiple disciplines, ensuring you get the right solutions to help you prosper!

Letter From Private Wealth Advisors President

As we flip the page on another year, I challenge myself to make sense of how past experiences can inform future decisions to make me a better leader, advisor, husband, father, person. This year, as I apply that reflection to the specific challenges of leading our business, I am struck by the eroding level of trust the public has in most institutions. Recent Gallup surveys show that only 26% of US respondents say they have a high level of trust in Banks. The same amount as Big Tech companies, public schools and *gulp* The Presidency. In a year where public distrust for elected officials reached new heights and had no political boundary, I know we have our work cut out for us.

So how do we counter the narrative? Simple, we focus on fulfilling our mission. Our team rallies around a distinct statement every day, that we will “partner with individuals, families and institutions to attentively provide comprehensive solutions and personal service in pursuit of a secure financial future”. The three phrases I highlight are critical to our success in helping our clients prosper. Personal service may mean different things to different people; however, it is foundational to ensuring high levels of trust with our clients. Your experiences should feel personally engaging and if we fail to deliver, we are committed to putting in the work to improve. The linkage between comprehensive solutions and a secure financial future requires us to face certain contradictions in our profession. I call this the “Advisors Paradox” in that we must focus on creating long-term and stable plans for our clients, while embracing and adapting to the change that threatens the success and stability of those plans. Navigating our clients through the short-term noise yet embracing the resonant signals in an ever-evolving industry and world.

In a year where national politics dominated the airwaves, and rarely in a positive way, I am energized by working with our teams in their unwavering focus on helping our clients prosper. Every year we can reflect on prior events and be struck by the amount of adversity we have faced. Yet over time you realize that adversity is just a part of the contract. There will always be challenges and how we react is what we can control. Your team at First Merchants shows up to work every day focused on ensuring your plans are resilient in the face of ever-present adversity. Making sure your long-term plans are not knocked off track by short-term concerns yet adapt to the evolutionary changes in our world. It’s not a job for our team, it’s a passion and a vocation and that is what you should expect from your partner. Thank you for the trust you have placed in First Merchants and enjoy “The Long View.”

Michael Joyce

PRESIDENT

Here We Go Again

As 2024 comes to a close and the country prepares for another transition of power, we find ourselves zooming out once again to take stock of events of the prior year and look ahead toward 2025. The past year generally played out as expected, albeit with one notable exception. The presidential election played out differently than we may have expected at the beginning of the year, with the Democratic ticket changing mid-campaign; more on that later. In terms of the economy, the broad themes that were top of mind a year ago such as inflation and labor markets remain important today but have taken a back seat to new priorities stemming from the outcome of the presidential election. Headlines today are more preoccupied with tariffs, immigration, and tax cuts. While we understand the broad strokes of the policy prescriptions of the incoming administration, uncertainty remains around the magnitude of the changes to be proposed and the government’s ability to implement the agenda. Before we turn to our outlook for 2025, we will review the economy and financial markets in 2024.

A year ago, our focus was on whether the economy would manage a “soft landing” or worse. We had predicted that the economy would slow but not enter a recession, inflation would continue to moderate, pressure on labor markets would ease, and the Fed would begin its easing cycle mid-year. In the end, the hard landing was avoided, and some may question if we even landed at all. Inflation moderated modestly from 3.0% to 2.6% in June, but progress fell short of the Fed’s stated 2% target and has since climbed back to 2.8%. Likewise, pressure in labor markets eased and unemployment rate increased slightly from 3.7% at the end of 2023 to 4.3% in July but has since dropped back to 4.2% and is expected to tighten again. More importantly, the Employment Cost Index is still rising at 3.8%, and the Atlanta Wage Tracker is rising at 4.3%. In other words, the economy is still running a little hotter than the Fed’s stated dual mandate and progress toward achieving their price stability goal appears to have stalled. Not surprisingly, these trends were reflected in stronger than expected GDP growth in 2024.

A year ago, our focus was on whether the economy would manage a “soft landing” or worse. We had predicted that the economy would slow but not enter a recession, inflation would continue to moderate, pressure on labor markets would ease, and the Fed would begin its easing cycle mid-year. In the end, the hard landing was avoided, and some may question if we even landed at all. Inflation moderated modestly from 3.0% to 2.6% in June, but progress fell short of the Fed’s stated 2% target and has since climbed back to 2.8%. Likewise, pressure in labor markets eased and unemployment rate increased slightly from 3.7% at the end of 2023 to 4.3% in July but has since dropped back to 4.2% and is expected to tighten again. More importantly, the Employment Cost Index is still rising at 3.8%, and the Atlanta Wage Tracker is rising at 4.3%. In other words, the economy is still running a little hotter than the Fed’s stated dual mandate and progress toward achieving their price stability goal appears to have stalled. Not surprisingly, these trends were reflected in stronger than expected GDP growth in 2024.

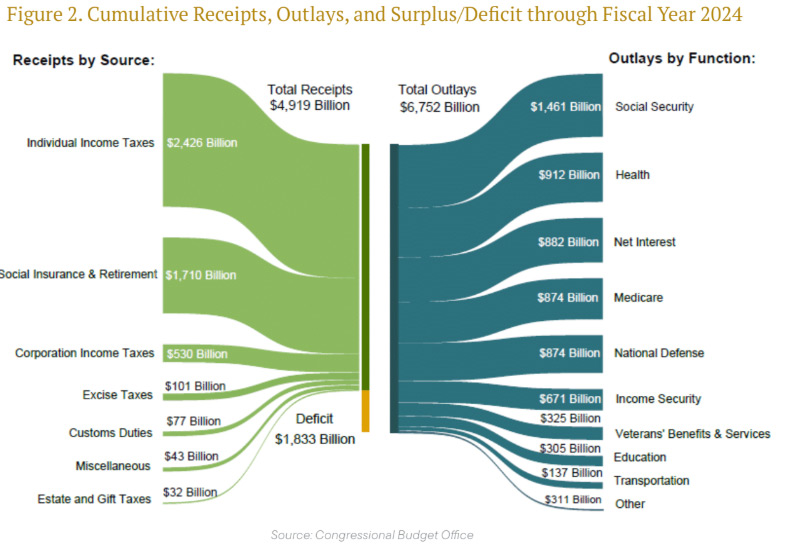

In terms of fiscal policy, government deficit spending continued just as expected – especially considering it was an election year. Correspondingly, we added $1.4 trillion to our national debt in the first 9 months of 2024, and it now stands at 121% of GDP. This will continue to have a negative impact on our national interest expense, which is now larger than our national defense expenditures – just as we had anticipated last year. Unfortunately, tackling our deficits and national debt was not a priority on the campaign trail for either party and a balanced budget will not be in the cards in 2025.

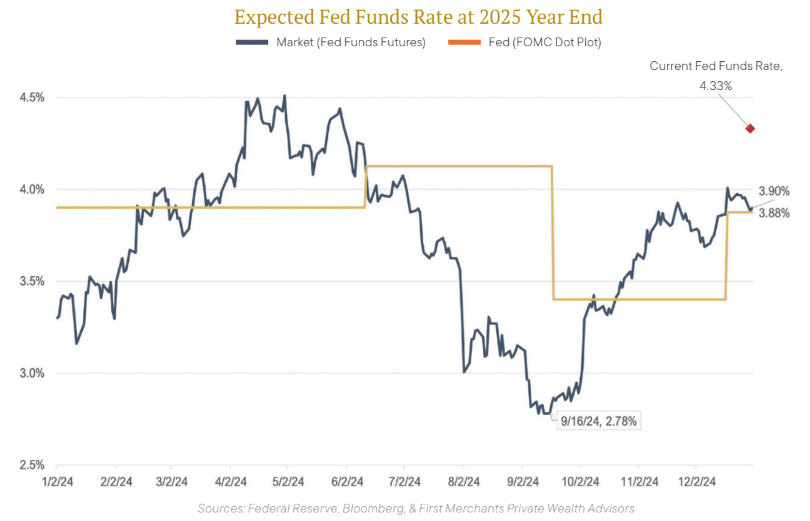

The Fed initiated its interest rate cutting cycle in 2024 as we anticipated. We had expected the easing cycle to begin mid- summer, with 5-6 rate cuts for the year. However, the Fed delayed the start of their easing cycle until September and only cut 4 times in 2024. We were surprised to see them kick off this easing cycle with a 50 basis-point cut, especially in light of their stalled progress toward achieving their 2% inflation target. The market has since come around to the view that the Fed may not have as many rate cuts up their sleeve as originally expected, and will be on the lookout for signs of a re-acceleration in inflation.

With both monetary and fiscal policy supporting the economy, it’s no surprise that stock markets responded favorably. Equity markets delivered a second consecutive year of exceptional returns in 2024 with U.S. large cap stocks leading the way amid sustained AI fervor. As expected, the S&P 500 delivered solid fundamental growth with earnings per share rising 10% in 2024, but once again valuation expansion proved to be the even larger driver in the index’s 25% advance as the price to earnings ratio of the index inflated from under 23x at the start of 2024 to 27x at the end based on aggregate last 12-month earnings. Meanwhile, small cap stocks lagged behind larger peers with a volatile ride in 2024 due to greater sensitivity to interest rates and the economic outlook that continually shifted throughout the election year. However, the Russell 2000 still managed to log a 11.5% total return on the year, despite a weak first half and an 8% sell-off in December to close out the year.

With both monetary and fiscal policy supporting the economy, it’s no surprise that stock markets responded favorably. Equity markets delivered a second consecutive year of exceptional returns in 2024 with U.S. large cap stocks leading the way amid sustained AI fervor. As expected, the S&P 500 delivered solid fundamental growth with earnings per share rising 10% in 2024, but once again valuation expansion proved to be the even larger driver in the index’s 25% advance as the price to earnings ratio of the index inflated from under 23x at the start of 2024 to 27x at the end based on aggregate last 12-month earnings. Meanwhile, small cap stocks lagged behind larger peers with a volatile ride in 2024 due to greater sensitivity to interest rates and the economic outlook that continually shifted throughout the election year. However, the Russell 2000 still managed to log a 11.5% total return on the year, despite a weak first half and an 8% sell-off in December to close out the year.

Overseas, international stocks posted more modest gains than in the U.S. with less tailwinds from growth and valuation expansion. Additionally, the sustained rise of the U.S. Dollar posed a significant headwind to international gains for U.S.-based investors. Developed markets returned 4.4% for the year based on the MSCI EAFE index (11.8% in local currency), while the MSCI Emerging Markets index climbed 8.1% (13.7% in local currency).

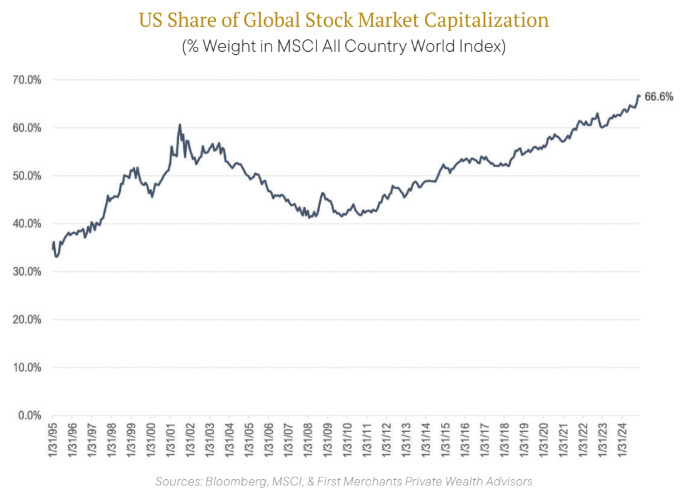

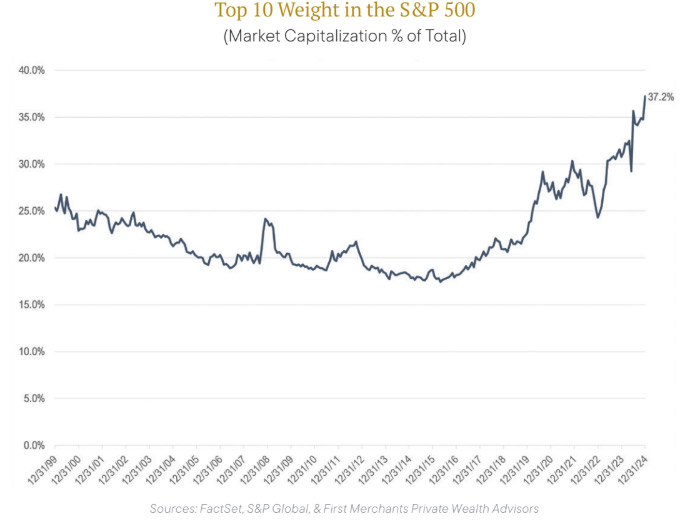

One of the most notable themes of global equity markets in recent years has been the rise of concentration to historical highs, as depicted in the charts on the previous page. The U.S. equity market now accounts for almost 67% of the weight of the global stock market, compared to accounting for just over a quarter of global nominal GDP. Meanwhile, the U.S. equity market has been increasingly top heavy as well with the top 10 stocks now accounting for 37% of the S&P 500 following the sharp appreciation of big tech stocks. The Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, & Tesla) accounted for over 50% of the S&P 500’s gain in 2024 after supplying over 62% of the index’s return in 2023.

Those large tech companies in turn are increasingly dependent on the payoff of significant investments in artificial intelligence. As a result, AI will remain a dominant headline in the global market conversation next year as investors seek to assess broadening adoption of new innovations and the sustainability of growing capital expenditure plans backed by proven return on investment.

Bond markets also maintained positive gains in 2024, though returns were slightly below our expectations as the Bloomberg U.S. aggregate bond index only managed a 1.3% total return. This was due to a reversal in bond yields, which bottomed in September and have been climbing from there. The rise in bond yields was likely in response to the pro-growth policies expected from the incoming administration. With the Fed pushing short term interest rates down, and intermediate and long- term yields rising in anticipation of more robust economic growth, the yield curve steepened in 2024. In fact, the yield on 10-year U.S. Treasury bonds rose above the yield on 2-year Treasury bonds for the first time since they inverted in 2022.

In summary, the year in review came in generally as expected on a fundamental basis, but financial market performance surpassed even the most optimistic of forecasts on Wall Street as investors leaned further into risk assets. The Fed began easing by cutting the Fed Funds rate, and long-term interest rates were anchored at higher levels in response to strong expected economic growth. Credit spreads, meanwhile, are pricing in minimal risk as they hover near all-time historic lows. Equity markets had another strong year in response to easing monetary conditions and prospects of continued fiscal support in the form of deficit spending and enthusiasm around AI. Perhaps the biggest surprise of the year was the unusual developments in the national election as one of the tickets swapped candidates mid-race. We will explore this topic further in our Outlook section.

You invest time in achieving goals and creating a legacy. Our team of wealth advisors—wealth managers, portfolio managers, private bankers, and advisors—provides personalized, adaptable solutions tailored to your evolving needs. Guided by strategic imperatives in professional services, business ownership, and inherited wealth, we deliver private wealth services to support your success for generations.

Financial and Estate Planning and Fiduciary Services

- A crucial yet often overlooked aspect of financial management

- Personalized consultations

- Tailored strategies and solutions

- A generational approach to planning

- Expertise in business succession planning

- Collaborative support with your trusted advisors, including attorneys, accountants, and others

Investment Management

- Develop personalized investment policy statements

- Create tailored portfolios aligned with client goals

- Uphold fiduciary responsibility

- Offer diversified equity and fixed-income portfolio management

- Provide access to expert research and management teams

- Deliver fee-based, disciplined portfolio management

Physicians First

- Customized financial strategies designed for physicians

- Unique financial health plans that incorporate any of the following services:

- Complimentary Financial Review

- Private Checking Account

- Physician Mortgage Program

- Line of Credit

- Practice Buy-in Financing

Business Succession

- Tailored, conscientious approach to maximize peace of mind

- Collaborative business succession planning to ensure goals and dreams

- Retirement preparation

- Ensure smooth transition plan for employees and customers

Corporate Retirement Plan Services

- A vital benefit to attract and retain employees

- Flexible plans for businesses of any size

- Start fresh or transfer an existing plan with ease

- Explore a variety of plan options

- Expert guidance to find the best fit for your business

- Benefits include potential tax savings, employee retention, and secure retirements for all

Private Banking

- Exclusive banking services for clients

- Preferred depository accounts for personal cash management

- Specialized solutions for professionals, including the Physicians First program

- Custom financing options, such as lines of credit, home equity lines, and specialized mortgages

- Tailored lending for personal and professional investments

Whereas our focus in 2024 was centered around the Fed’s ability to land the economy softly, the Republican sweep in the 2024 elections will have significant repercussions in 2025 and beyond. To say the incoming Trump administration’s policies will present a significant change of direction is an understatement. Starting next year, we will see dramatic changes in immigration policy, tax policy, and trade policy. There will even be a re-thinking of the role of government and how it conducts its activities, anchored by the new Department of Government Efficiency, DOGE (which ironically has two heads!), and supported by appointments to key positions by people outside the political mainstream.

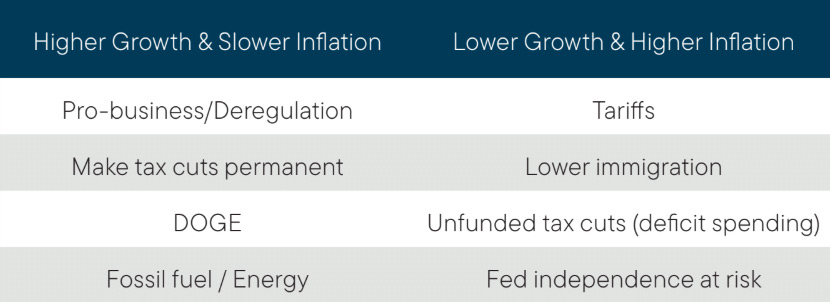

Unfortunately, for our purposes of assessing the future of the economy and financial markets, all these changes present increased uncertainty. Part of the challenge stems from the fact that many of the policy prescriptions have opposing effects on growth and inflation, making the net impact difficult to ascertain. Additionally, although we have a sense of direction for many of the anticipated policies, we don’t know the extent to which the incoming government will be able to implement them. Finally, as with most economic measures, there are short-term impacts and long-term impacts. For this reason, we will attempt to break things down by expected policy rather than by more traditional economic measures.

Immigration

Trump vowed to curtail illegal immigration and even suggested mass deportations. It’s easy to see why this was a hot topic on the campaign trail with an estimated total of 8 to 10 million people having entered the U.S. in recent years. This caused disruptions at the border and made it difficult for many cities to cope with the large influx of people. It’s fair to say the U.S. is a country of immigrants and has a strong tradition in that regard, but the large and disorganized entry of asylum seekers and illegal immigrants in recent years has stressed our ability to assimilate new entrants into our society.

From an economic standpoint the impact of immigration is more nuanced. Our economy is a function of capital and labor; in other words, total economic output is dictated by the total number of workers and the total number of “machines” at their disposal to produce goods and services. When the labor force grows— through immigration or otherwise— it typically increases economic growth, tempers wage growth and puts downward pressure on inflation. This is generally good for business and society at large. However, the impact of the recent surge in immigration and competition for job openings has not been evenly felt across the U.S. population.

From an economic standpoint the impact of immigration is more nuanced. Our economy is a function of capital and labor; in other words, total economic output is dictated by the total number of workers and the total number of “machines” at their disposal to produce goods and services. When the labor force grows— through immigration or otherwise— it typically increases economic growth, tempers wage growth and puts downward pressure on inflation. This is generally good for business and society at large. However, the impact of the recent surge in immigration and competition for job openings has not been evenly felt across the U.S. population.

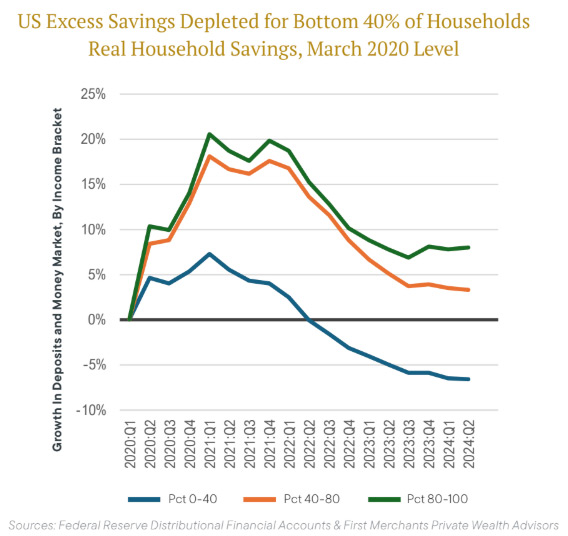

Lower income families in the U.S. have suffered a series of setbacks in recent years and immigration only added to their angst. During the COVID pandemic, many lower- income service jobs were either lost or considered “essential” and didn’t have the privilege of working from home. The stimulus checks government doled out helped ease the impact of layoffs and furloughs on lower income workers. However, the high inflation that ensued meant that the temporary income boost was spent on basic items and these families have now depleted their excess savings.

Lower income families in the U.S. have suffered a series of setbacks in recent years and immigration only added to their angst. During the COVID pandemic, many lower- income service jobs were either lost or considered “essential” and didn’t have the privilege of working from home. The stimulus checks government doled out helped ease the impact of layoffs and furloughs on lower income workers. However, the high inflation that ensued meant that the temporary income boost was spent on basic items and these families have now depleted their excess savings.

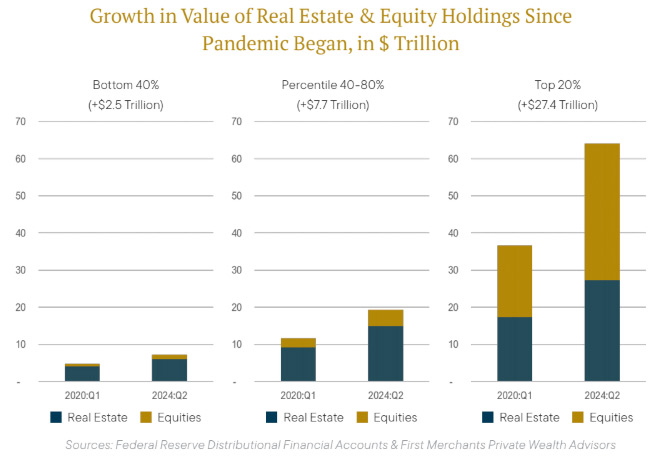

.jpg?sfvrsn=22a610cc_1) Additionally, lower-income families did not benefit from the rapid rise in asset prices in recent years. As we have documented previously, the large fiscal and monetary response to the pandemic resulted in rapid appreciation in the values of assets such as real estate and equities. However, lower income families have little in the way of real estate and have minimal equity holdings so most of the benefit accrued to higher income households. In a nutshell, lower income households bore the brunt of the stressful employment situation created by the pandemic, they did not participate in the wealth creation via ownership in real estate and stocks, and they saw their modest incomes eroded by the detrimental effects of inflation.

Additionally, lower-income families did not benefit from the rapid rise in asset prices in recent years. As we have documented previously, the large fiscal and monetary response to the pandemic resulted in rapid appreciation in the values of assets such as real estate and equities. However, lower income families have little in the way of real estate and have minimal equity holdings so most of the benefit accrued to higher income households. In a nutshell, lower income households bore the brunt of the stressful employment situation created by the pandemic, they did not participate in the wealth creation via ownership in real estate and stocks, and they saw their modest incomes eroded by the detrimental effects of inflation.

It is in this context that immigration became a threat to lower-income families. New entrants into our society are most likely to compete for the very same jobs held by lower-income workers. According to the Bureau of Labor Statistics, “foreign-born workers were more likely than native-born workers to be employed in service occupations; natural resources, construction, and maintenance occupations; and in production, transportation, and material moving occupations. Foreign-born workers were less likely than native-born workers to be employed in management, professional, and related occupations and in sales and office occupations.”

The incoming administration will undoubtedly have a more stringent approach toward immigration, and we expect immigration will decline as President Trump has promised. The uncertainty lies in the mass deportations as there are practical considerations that may limit implementation of the most aggressive proposals.

Tax & Trade Policy

It is clear President Trump believes in a pro-growth agenda and low taxes are one of his keys to success. His primary ideas regarding tax policy include making the 2017 Tax Cuts and Jobs Act (TCJA) permanent rather than sunsetting in 2025, reducing corporate taxes from 21% to 15%, and imposing high tariffs on imports from targeted countries and industries. An important consideration for Trump’s of extending the TCJA is that the benefit has already accrued in the economy – he would simply be keeping it from reverting to levels prior to 2017. With regards to lowering corporate taxes, these currently represent less than 8% of government expenditures and the change will likely have a modest impact on the economy.

The most significant, if not controversial, part of Trump’s tax proposals are the high tariffs he has proposed on some of our trading partners. After decades of free market ideals and liberal trade policies, erecting a tariff wall with our trading partners represents a significant departure. The details on the tariff proposals have not been fully ironed out, so we don’t yet know the exact level of tariffs, the final list of countries that will be targeted, and the exceptions which will undoubtedly follow. Some pundits have suggested the incoming administration will use the threat of tariffs as a negotiation strategy which can be wielded for non-trade purposes. For example, recent threats of high tariffs toward Mexico may be a negotiating tactic for other objectives such as border security. But the fact remains that the mere threat of tariffs may already be causing disruptions to businesses in the U.S. and abroad. For example, some companies may be front running the purchase of goods before they are subject to new tariffs, and other companies may be postponing investment plans on account of increased uncertainty.

The most significant, if not controversial, part of Trump’s tax proposals are the high tariffs he has proposed on some of our trading partners. After decades of free market ideals and liberal trade policies, erecting a tariff wall with our trading partners represents a significant departure. The details on the tariff proposals have not been fully ironed out, so we don’t yet know the exact level of tariffs, the final list of countries that will be targeted, and the exceptions which will undoubtedly follow. Some pundits have suggested the incoming administration will use the threat of tariffs as a negotiation strategy which can be wielded for non-trade purposes. For example, recent threats of high tariffs toward Mexico may be a negotiating tactic for other objectives such as border security. But the fact remains that the mere threat of tariffs may already be causing disruptions to businesses in the U.S. and abroad. For example, some companies may be front running the purchase of goods before they are subject to new tariffs, and other companies may be postponing investment plans on account of increased uncertainty.

One of the stated objectives of the tariffs will be to use them as a source of revenue to fund tax cuts elsewhere, but there are drawbacks to this proposal. Tariffs will cause a deadweight loss to society. By raising taxes on U.S. consumers in the form of higher import tariffs, we will see higher prices for many goods that Americans consume, from cars, to electronics, to clothes, for example. The short-term effects will likely be higher inflation, but this may subside over time as we adjust our consumption patterns. A more severe consequence of high tariffs may come in the form of reduced foreign demand for our own goods and services, should countries retaliate against our tariffs by implementing their own and taxing our exports into their countries. For example, if we place a high tax on French wine, they may place a high tax on our bourbon. For historical perspective, the Smoot-Hawley Tariff Act of the 1930s is said to have prompted retaliatory tariffs by other countries, causing a trade war and significantly contributing to the Great Depression.

Deregulation

Deregulation under the incoming Trump administration is expected to reduce corporate burdens across sectors such as energy, financial services, and manufacturing. Easing regulatory constraints could lower compliance costs and create a more business-friendly environment, encouraging capital spending and expansion. This shift may also accelerate merger and acquisition (M&A) activity, as companies take advantage of reduced regulatory hurdles to consolidate and grow market share. Financial institutions, in particular, could benefit from relaxed oversight, potentially leading to greater lending activity and more competitive deal- making. However, while deregulation may provide short-term boosts to earnings and investment, it could also increase systemic risks over the long term, particularly in industries where oversight plays a stabilizing role.

To recap, the new administration is expected to be business friendly, favor lower taxes, seek to eliminate wasteful spending (DOGE), and reduce burdensome regulation. But despite the good intentions of the stated policies, three are two sides to the coin. Reduced immigration and higher tariffs would likely result in lower growth and higher inflation. Also, recent threats to Federal Reserve independence would not be welcome by financial markets at a time we need to borrow ever-larger amounts to fund our spending. In all, it’s safe to say we’re cautiously optimistic on the direction of the economy in 2025 and the outcome will hinge on the new government’s ability to manage the balance of risks.

Financial Markets in 2025

The net impact of the new administration’s policies on financial markets will likely be mixed. On the positive side, corporations are riding strong profit growth momentum heading into 2025 and the election outcome boosts the likelihood of deregulation, lower taxes, and renewed business confidence driving investment. However, rising geopolitical tensions and protectionist trends pose risks to global trade. Additionally, continued deficit spending, tariffs, reshoring of manufacturing, and lower immigration may push inflation and interest rates higher, putting pressure on elevated market valuations.

Fixed income markets are increasingly reflecting the potential for inflation to remain stuck above target, thereby limiting the ability of the Federal Reserve to ease rates lower. Following the December rate cut that brought the federal funds rate down to 4.33%, markets now only price in one to two more rate cuts in 2025 as the Fed searches for the right gear for monetary policy. That’s a far cry from where expectations were just a few months ago as shown in the chart below. Meanwhile, with credit spreads at historic lows, investors are not receiving much compensation for reaching down the credit risk spectrum to enhance income. As a result, we continue to focus on moving fixed income portfolios up in quality. While upside risks to inflation pose a potential headwind to bond returns, real yields net of expected inflation for high-quality bonds remain firmly positive to compensate and help savers maintain purchasing power, while also protecting portfolios against equity market volatility after a tremendous bull run.

The outlook for the U.S. equity market shows strong earnings growth momentum, but current valuations remain well above historical averages. This optimism leaves little room for error. Analysts forecast S&P 500 annual earnings growth to rise from about 10% in 2024 to nearly 15% in 2025, followed by 13% growth in 2026. Meeting these high expectations will likely depend on continued AI investment momentum and broader earnings growth beyond the largest U.S. stocks.

The outlook for the U.S. equity market shows strong earnings growth momentum, but current valuations remain well above historical averages. This optimism leaves little room for error. Analysts forecast S&P 500 annual earnings growth to rise from about 10% in 2024 to nearly 15% in 2025, followed by 13% growth in 2026. Meeting these high expectations will likely depend on continued AI investment momentum and broader earnings growth beyond the largest U.S. stocks.

On the former point, JP Morgan has forecast that the Magnificent Seven alone will invest $500 billion next year in capital expenditures and R&D in 2025, largely AI-related. Total corporate spending on AI could surpass $1 trillion, exceeding the U.S. defense budget. Investors will need to see clear product innovation and solid returns on these investments next year.

On the latter point, there was a significant gap in earnings growth between the Magnificent Seven and the rest of the market in 2024 as the tech giants logged 33% earnings per share growth compared to 4% for the rest of the S&P 500, according to FactSet. This gap is expected to narrow in 2025, as the Magnificent Seven’s growth slows to 20% and the rest of the market accelerates to 13%.

While large U.S. tech stocks have boasted superior profitability and ability to grow at scale, that strength is well-recognized by their rich valuations that have seen a growing disparity against the rest the market. The top 10 U.S. stocks are priced at nearly 30 times forecasted 2025 earnings, compared to less than 20 times for the rest of the S&P 500. The valuation gap is even larger when comparing U.S. growth stocks to value stocks or U.S. equities to international markets.

When looking in the rearview mirror, it may be tempting to ride the hot hand of U.S. large cap tech stocks and shy away from diversification to areas of the market that have delivered more modest returns in recent years. However, given the potential for converging earnings growth relative to historically wide valuation gaps and mounting upside risks to interest rates, our investment team believes diversification is now more critical than ever. We believe it is an optimal time to explore opportunities in less-appreciated areas of equity markets, while maintaining a bias toward high- quality companies.

The Intent Behind Your Money: An Attentive Approach to Managing Your Assets

Wealth management is complex.

Beyond the intricate intersection of tax, accounting, and legal factors, there’s another equally profound element: protecting and building your wealth is inherently personal and deeply emotional.

Every figure on your balance sheet, every asset in your holdings, reflects a heartfelt desire—whether it’s safeguarding your family’s future or honoring the legacy of those who built the foundation of your wealth.

At First Merchants Private Wealth Advisors, we understand this delicate balance. That’s why we begin by listening. Thoughtful, clarifying questions guide our discovery, but our focus is on understanding not only the details of your assets but also the dreams and aspirations they represent.

With this understanding, we craft an adaptive plan tailored to your unique needs. Grounded in proven strategies yet flexible enough to evolve with changing markets and times, your plan will reflect the expertise of our team and insights from trusted external advisors when needed.

Your First Merchants Private Wealth Advisors team brings the talent, experience, and resources to carefully design a strategy that preserves and grows your assets—ensuring your family’s future while building your legacy. We will accomplish this together while remaining committed to a singular goal: attentively helping you prosper.