Financial Wellness

Financial Wellness Tools and Education

What is financial wellness? Depending on who you are, financial wellness could mean being able to afford your bucket list, saving enough to pay for college, or having what you need to buy groceries. Either way, it’s about trading stress and anxiety for security and having the right tools and advice to know where your finances stand today and where you’d like them to be in the future.

No matter where you’re starting from, we’re here to support you throughout your financial wellness journey.

Take the First Step

Ready to dive deep into managing your finances, budgeting, paying off debt, and becoming financially independent? The tools below can help you get started.

Tap into our online learning libraries.

Will renovating your kitchen add value to your home? Which is better – an IRA or a CD? Find the knowledge you need to make solid financial decisions in our Resource Hub.

Learn how to budget and invest or gain insights on how you react to financial stress and build a money mindfulness practice through self-guided learning with Financial Wellness powered by Enrich.

Use the tools in your app and our website to take control of your money.

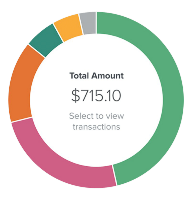

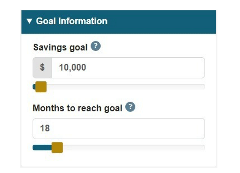

Set savings goals, manage your budget, and get personalized tips on how to make the most of your money with a free Personal Finance Tool.

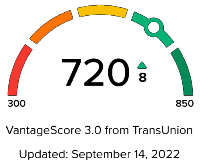

Get real-time alerts for changes to your credit score, monitor your score, or create an action plan that will help you improve your credit with a built-in credit score monitor.

Chart your path to freedom from debt, weigh whether renting or buying is better, compare CDs, and more with a financial calculator.

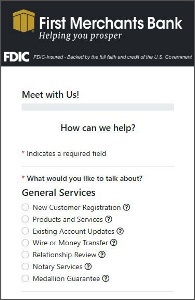

Meet one-on-one with a knowledgeable partner.

Get a listening ear and expert advice when you chat with one of our welcoming bankers. They’ll help you identify and set financial goals so you can prosper.

Skip the Line – make an appointment with a banker for a day and time that works for you!