YEAR IN REVIEW - 2023

2023 Year-in-Review: Economic & Market Summary

Following a very challenging year in the financial markets in 2022, investors were treated to a reprieve in 2023. Although interest rates continued to rise during the year, the pace of the increases slowed as the year wore on. The slowing pace of rate increases allowed bond prices to recover from last year’s rout and approach year end with a positive return. Stocks also rebounded after a dizzying 2022 that saw the S&P 500 lose nearly 20% and the Nasdaq decline more than 30%. It was a complete reversal in 2023, with the S&P 500 up 26% and the Nasdaq up 45% through the year.

It was a particularly good year for stocks in the technology sector, most notably a group of seven companies referred to as the “Magnificent Seven.” The market capitalization of this group (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, Tesla) increased by more than 70% in 2023. The market capitalization of the remaining 493 stocks in the S&P 500 increased by 12% during the year, meaning without the “Magnificent Seven,” returns for the S&P 500 would have been much more modest. The Magnificent Seven market leadership also led to a wide disparity in growth vs. value stocks on the year, with the former outpacing the latter by over 30%, per the Russell 1000 index series. This was, again, a reversal from 2022, which saw value stocks dramatically outperform growth stocks in a down market. Small and mid-cap stocks finished in positive territory for the year, though the returns weren’t as robust as their large-cap counterparts. International stocks also posted positive returns, with Japan’s Nikkei index up more than 30% and approaching levels not seen since the late 1980s.

.png?sfvrsn=380c9ad_1) Recessionary fears were high early in the year as the economy struggled to deal with the aggressive rate hike cycle. The financial system in particular experienced stress as higher rates pushed bond values down, and rising competition for deposits deprived banks of much needed liquidity. Several large banks that had extended the duration of their bond portfolios and had concentrated, volatile deposit bases, were unable to weather the storm and failed during the first quarter of 2023. This led to a regional bank “crisis” with the stock prices of most regional banks around the country falling -30% to -50% in the aftermath.

Recessionary fears were high early in the year as the economy struggled to deal with the aggressive rate hike cycle. The financial system in particular experienced stress as higher rates pushed bond values down, and rising competition for deposits deprived banks of much needed liquidity. Several large banks that had extended the duration of their bond portfolios and had concentrated, volatile deposit bases, were unable to weather the storm and failed during the first quarter of 2023. This led to a regional bank “crisis” with the stock prices of most regional banks around the country falling -30% to -50% in the aftermath.

Rising rates also stoked fears of a housing market crash, as 30-year mortgage rates approached 8% for the first time since 2000. The rapidly rising cost of an average home in the U.S. combined with high mortgage rates looked poised to derail housing demand, especially for first-time homebuyers. While housing demand did slow in 2023, tightening housing supply served to offset the lower demand as existing homeowners refused to part with their low-rate mortgages resulting in fewer homes listed for sale. This supply/demand equilibrium helped sustain housing prices and avoid a crash in residential real estate. The median price of a home in the United States now stands at $413,500, a 50% increase from just five years ago. Commercial real estate, on the other hand, continues to struggle in the aftermath of the COVID pandemic. According to Moody’s Analytics, nationwide office vacancy rates climbed to 19% in 2023, matching a historical high, as the remote-work trend appears to have gained a foothold.

Perhaps the biggest story for the economy and markets in 2023 was the widely anticipated recession that never came to fruition. Amid much handwringing early in the year, many in the financial press felt that a recession was unavoidable. With inflation still far above the Fed’s 2% target and further rate hikes on the horizon, surely the Fed would overtighten and send the U.S. economy into a recession. However, so far, that hasn’t happened. The rate of inflation fell throughout the year, with the CPI dropping toward 3.0%, down from last year’s peak of 9.1%.

.png?sfvrsn=208626b2_1) With inflation continuing to decline even during a pause in Fed rate hikes, there is reason for the Federal Reserve to believe further rate hikes may not be needed to bring inflation down the rest of the way to their 2% target. Meanwhile, economic growth surprised to the upside in Q3, buoyed by unhealthy government budget deficit spending and consumers spending down their dwindling COVID stimulus checks. We suspect unplanned liquidity injections following the budget ceiling and financial instability in Q2 may have also contributed.

With inflation continuing to decline even during a pause in Fed rate hikes, there is reason for the Federal Reserve to believe further rate hikes may not be needed to bring inflation down the rest of the way to their 2% target. Meanwhile, economic growth surprised to the upside in Q3, buoyed by unhealthy government budget deficit spending and consumers spending down their dwindling COVID stimulus checks. We suspect unplanned liquidity injections following the budget ceiling and financial instability in Q2 may have also contributed.

.png?sfvrsn=279112be_1) A consumer slowdown that was seen as inevitable has failed to materialize as a supportive labor market backdrop and improving real wage growth offset headwinds from the depletion of excess pandemic stimulus savings. Despite student loan payments resuming in September (taking a bite out of discretionary spending), this year’s Black Friday sales set new records. If there is one thing you can count on, it is Americans’ propensity to spend. In addition to improving real wages, many economists believe the continued spending despite high inflation can be attributed to “revenge spend.” Revenge buying refers to a surge in the purchase of consumer goods after people are denied the opportunity to shop, or spend, for extended periods of time. Much of the consumer spending in 2023 could potentially be attributed to revenge spending on travel, concerts, and other goods that consumers were denied during the COVID pandemic. It is estimated that Taylor Swift’s Eras Tour alone boosted the U.S. economy by $4.6 billion in 2023.

A consumer slowdown that was seen as inevitable has failed to materialize as a supportive labor market backdrop and improving real wage growth offset headwinds from the depletion of excess pandemic stimulus savings. Despite student loan payments resuming in September (taking a bite out of discretionary spending), this year’s Black Friday sales set new records. If there is one thing you can count on, it is Americans’ propensity to spend. In addition to improving real wages, many economists believe the continued spending despite high inflation can be attributed to “revenge spend.” Revenge buying refers to a surge in the purchase of consumer goods after people are denied the opportunity to shop, or spend, for extended periods of time. Much of the consumer spending in 2023 could potentially be attributed to revenge spending on travel, concerts, and other goods that consumers were denied during the COVID pandemic. It is estimated that Taylor Swift’s Eras Tour alone boosted the U.S. economy by $4.6 billion in 2023.

While wage gains are finally outpacing the rate of consumer price inflation, many Americans are treading water to maintain spending after exhausting excess savings during the past two-plus years of negative real wage growth. Americans unwilling to make lifestyle changes have chosen to use credit card debt to maintain current spending levels. Cumulative outstanding credit card balances in the U.S. passed $1 trillion in 2023 and continue to climb.

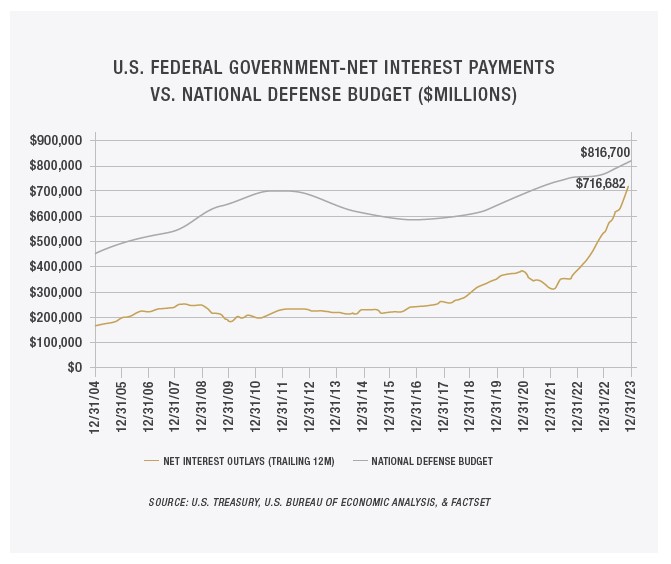

Not to be forgotten in the aftermath of the higher rate environment and large fiscal deficits is the significant increase in government interest expense. During the years of 2008 – 2016 when the Federal Funds rate was being held at 0%, the interest payments on U.S. Treasury debt hovered around $250 billion annually. With Treasury Bill rates rising from sub 1% in January 2022 to over 5% today, the net interest payments on U.S. Treasury debt have ballooned to nearly $700 billion annually. That number, net interest payments only, is quickly approaching the level the government spends annually on our National Defense Budget.

Overall, 2023 provided a nice rebound in the financial markets from a year ago. The Federal Reserve maneuvered rate hikes in a manner that effectively slowed inflation yet didn’t stall economic growth. Falling commodity prices (especially oil) and normalizing supply chain conditions following the COVID pandemic were both contributors to slowing inflation. We look for the positive momentum to carry forward into 2024. We’re thankful for your partnership during the year and look forward to continuing to work with you in 2024 and beyond.

Overall, 2023 provided a nice rebound in the financial markets from a year ago. The Federal Reserve maneuvered rate hikes in a manner that effectively slowed inflation yet didn’t stall economic growth. Falling commodity prices (especially oil) and normalizing supply chain conditions following the COVID pandemic were both contributors to slowing inflation. We look for the positive momentum to carry forward into 2024. We’re thankful for your partnership during the year and look forward to continuing to work with you in 2024 and beyond.