2024 Outlook

2024 Outlook

The runway is too short,” said the pilot when he aborted our landing after the second go-around at LaGuardia Airport in New York. It turns out the plane had a malfunction, and the flaps wouldn’t retract properly which meant we would have to perform a high-speed landing requiring a long runway. “We have to go back to Boston,” was the pilot’s pronouncement, leaving passengers to ponder, exactly how dangerous is a high-speed landing? We had an hour and a half to consider the potential outcomes as we turned around and headed back to our point of departure. I’ve been thinking a lot about that troubled flight lately as we consider the possibility of a hard landing in the economy.

Financial market performance in the year ahead hinges on the ability to navigate this tricky economic landing. Last year’s encouraging moderation in inflation was a boon to investor sentiment, but further progress ahead will depend on seeing relief in sticky core service prices, which are underpinned by elevated wage inflation. Labor markets remain tight, but there were some initial signs of softening in the second half of 2023 and inflation continued its slow descent, trends we expect will continue into next year.

As we had anticipated in last year’s outlook, the Fed paused their hiking cycle in the summer. The Fed’s interest rate hiking cycle reached its apogee, and the market now expects interest rate cuts in 2024.

We believe bond yields also peaked (in October) and are unlikely to reach new highs next year. Fiscal policy will likely remain unhinged. Nobody in Washington appears to be calling for higher taxes, and any voices calling for cuts to entitlements or military spending are muted at best. With elections on the horizon, the fiscal picture is unlikely to improve until 2025. In the meantime, our federal debt balance continues to grow.

Looking abroad, global headlines have been punctuated by increased geo-political tensions with continued bloodshed in Ukraine, violence in Israel and Gaza, and increased saber rattling in the South China Sea. Not surprisingly, the trend toward “near-shoring” and “friend-shoring” continues.

INFLATION

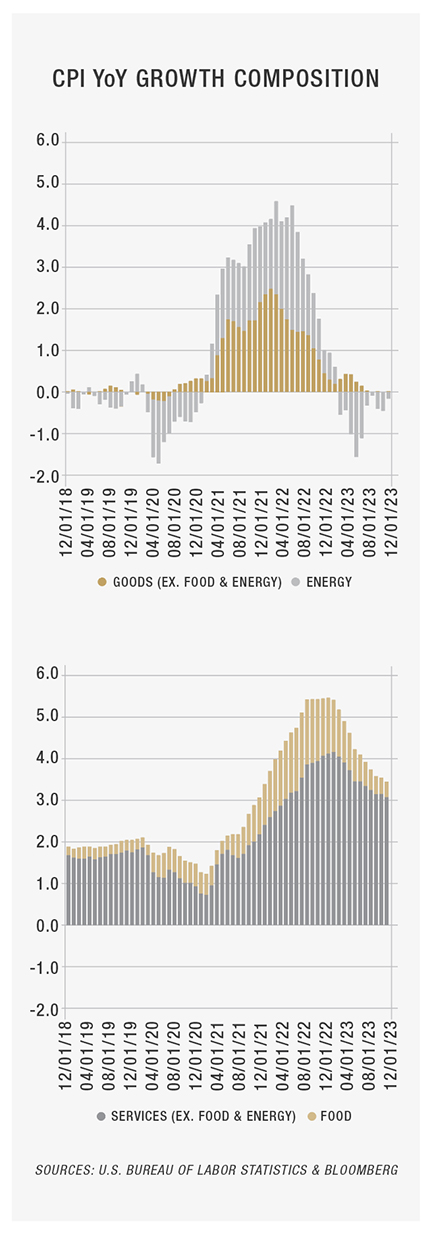

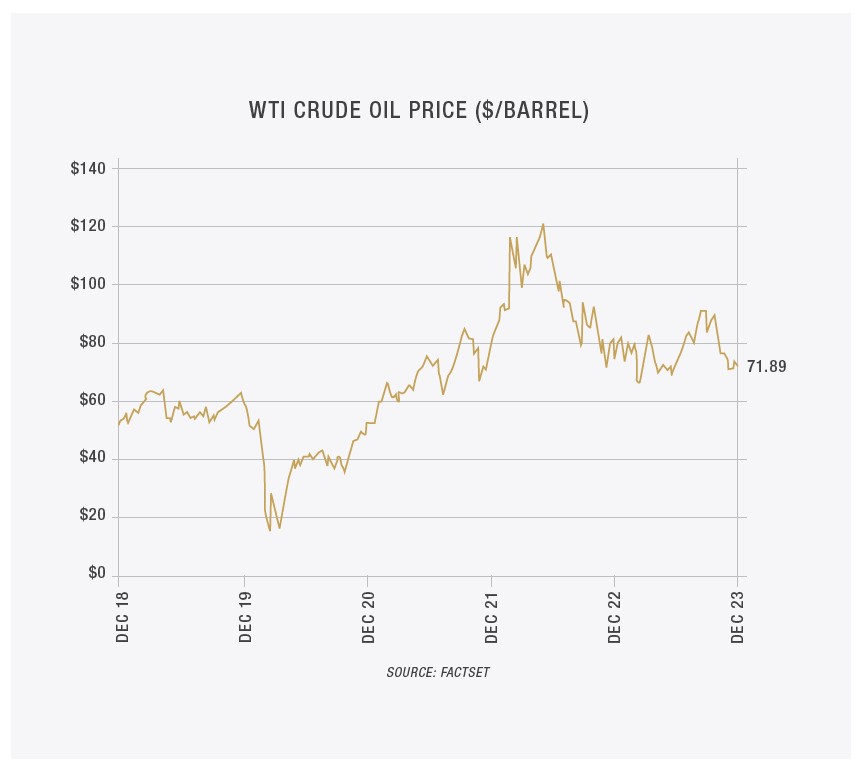

Inflation will continue to moderate through 2024 in response to the lagged effects of tighter monetary policy. Headline inflation dropped in no small measure due to lower energy prices, which declined by 40% since the 2022 highs to the price levels prevailing prior to the Russian invasion of Ukraine. Slower growth in China and higher oil production in the U.S. should offset production cuts by OPEC+. Although we expect energy prices to remain stable, they are notorious for being highly volatile and could easily jump again next year. Prices of finished goods also stabilized in 2023 as supply chains normalized, and we expect this trend to continue. But it’s too early to call “mission accomplished” as they remain meaningfully above the 2% target.

Inflation will continue to moderate through 2024 in response to the lagged effects of tighter monetary policy. Headline inflation dropped in no small measure due to lower energy prices, which declined by 40% since the 2022 highs to the price levels prevailing prior to the Russian invasion of Ukraine. Slower growth in China and higher oil production in the U.S. should offset production cuts by OPEC+. Although we expect energy prices to remain stable, they are notorious for being highly volatile and could easily jump again next year. Prices of finished goods also stabilized in 2023 as supply chains normalized, and we expect this trend to continue. But it’s too early to call “mission accomplished” as they remain meaningfully above the 2% target.

Even as price pressures from energy and finished goods have diminished, inflation in the service sector remains elevated. As of November 2023, shelter prices were up 6.5% year-over-year, services were up 5.5%, food away from home (restaurants) was up 5.3%, and medical care was up 5.0%. The final battle may prove to be the most difficult yet. If financial conditions become too tight, the economy could easily stumble into a recession; if they’re not tight enough, the inflation monster could rear its ugly head again.

LABOR MARKETS

.png?sfvrsn=96ffac13_1)

.png?sfvrsn=947a60e6_1)

As the Fed continues its battle against inflation, it’s important to remember they have a dual mandate: stable inflation (around 2%) and full employment. The last two years, a strong labor market allowed the Fed to focus fully on the inflation problem, knowing that they could restrain financial conditions while jobs were plentiful. Early in 2023, the unemployment rate hit a 54-year low of 3.4%, significantly below the 4.4% noncyclical rate of unemployment as estimated by the Congressional Budget Office – the equilibrium level of unemployment at which it is neither inflationary nor deflationary. Tight labor markets resulted in strong wage growth of 6.7% as measured by the Atlanta Fed’s Wage Tracker, contributing to inflation pressures.

Towards the end of 2023, however, we are seeing initial signs of easing in the labor market. There was a modest pullback in the number of job openings and the unemployment rate slowly climbed to 3.7%; the Congressional Budget Office expects it to climb to 4.4% next year. Wage growth decreased to 5.2% from its recent spike and the trend is headed in the right direction. As we look ahead to 2024, cooling labor market conditions will create a more delicate balance of risks for policymakers.

ECONOMIC GROWTH

.png?sfvrsn=ceb1f85d_1)

.png?sfvrsn=c116b8b4_1)

Real economic growth in the U.S. should come in around 2.6% in 2023 – not robust but much better than the recession that had been priced into the markets at the start of the year. Looking ahead to 2024, economic growth is expected to slow to 1.3% with risks to the downside. There are several factors contributing to the dour outlook, but the primary reason is the lagged effects of tight monetary policy.

Some estimates suggest it takes 18 months for the full effects of monetary policy to work their way through the economy. From March 17, 2022, to July 26, 2023, the Fed raised rates 11 times from (effectively) 0.25% to 5.25%– the most dramatic Fed rate hike cycle in over four decades. In conjunction with the rate hike policy, the Fed also implemented the sharpest quantitative tightening in history, reducing the size of their balance sheet by over $1.225 trillion. This policy prescription will continue to be felt through 2024. Once again, the Leading Economic Index published by The Conference Board points toward a slowdown, or even a recession, in the next 12 months.

BOND MARKETS

.png?sfvrsn=ae6ade1d_1/7-Inflation-VS-Market-Yields-(002).png)

.png?sfvrsn=d288ddfd_1/8-Bond-Index-Yields-(002).png)

Bond yields peaked in October 2023 and adopted a decidedly softer tone to close out the year. After dismal returns in 2022 and rangebound through most of 2023, the bond market found its mojo in Q4 as we head into the new year. The sharp decline in bond yields since October has led some bond indices to post the strongest 8-week returns since the 1980s, clearly suggesting markets expect the Fed’s hiking cycle is over. This should bode well for bond returns next year considering yields are still attractive relative to historical standards and the current level of inflation.

EQUITY MARKETS

The U.S. equity market outlook for 2024 largely hinges on the ability to thread the tight needle in accomplishing a soft landing. Strong U.S. equity market returns in 2023 were largely concentrated to a handful of mega-cap technology stocks, which now sit at quite elevated valuations, while gains for the rest of the market were more modest and their valuations sit at more reasonable levels (but still expensive by historical standards). The top 10 stocks in the S&P 500 are selling at nearly 30x their 2024 earnings expectations compared to 19x for the rest of the S&P 500 excluding the top 10. Altogether, the S&P 500 sells at over 21x next year’s earnings, which is over one standard deviation higher than the 20-year history (average was 17x).

Equity markets now anticipate both a notable acceleration in earnings growth and substantial rate cuts. Consensus forecasts for the members of the S&P 500 point to an earnings growth of 12% in each of the next two years compared to an expected earnings growth of less than 2% in 2023. Meanwhile, fixed income markets reflect expectations for 5-6 rate cuts next year. However, such strong earnings growth may be difficult to achieve while also seeing the necessary cooling in economic growth and inflation that allow for such substantial rate cuts. Needless to say, expectations may be overly optimistic.

Further upside in 2024 would likely require continuing broadening of market performance, which began in late 2023 and would be supported by remaining on the soft-landing trajectory. Smaller capitalization stocks are much more sensitive to changes in the economic growth outlook and changes in inflation and interest rates, while large-cap stocks are less reliant on domestic economic growth and interest rate conditions due to a higher proportion of revenue from overseas and generally stronger financial positions and access to capital markets.

Upside inflation surprises or downside economic growth surprises create downside market risk from today’s extended valuations, and both would pose obstacles to broadening market performance. Meanwhile, the extended valuations of high-quality large-caps limit their upside in a flight-to-quality situation driven by upside inflation or downside growth surprises.

International equity markets saw more balanced performance in 2023 and broadly sit at more modest valuations compared to the U.S. The top 10 stocks in the S&P 500 accounted for 73% of the index’s 2023 total return of 20.8% through Nov. 30. Meanwhile, the top 10 stocks in the MSCI EAFE only accounted for 17% of the index’s total return of 13.5% through Nov. 30. International markets are less top-heavy compared to the U.S. as the top 10 stocks in the EAFE account for less than 15% of the index’s weight compared to the S&P 500 where the top 10 account for nearly 33% of the index.

SUMMARY

The economic and financial market whiplash from the COVID pandemic is in its final throes. Following the complications from shutdowns, supply chain disruptions, policy intervention, and the resulting inflationary spike, the global economy is returning to a (somewhat) more normal operating environment. Economic growth is expected to be below average in the U.S. and abroad as inflation falls closer to target levels. The risk of a shallow recession is still on the horizon.

On the plus side, real interest rates are at their highest levels since the global financial crisis in 2008. This means bonds are back on the table as a viable source of return in addition to their risk- mitigating characteristics. Equity market valuations are vulnerable at the current level of interest rates, especially given the rosy outlook for earnings growth. We believe, however, there are attractive pockets of relative value in domestic and foreign markets for long-term investors if you know where to look.

In the end, our flight from Boston to NYC (and back to Boston) landed smoothly without a hitch. The task ahead for the Fed is equivalent to a high-speed landing in the short runways at LaGuardia. Can it be done? Absolutely. Thus far the markets have been surprised at how well the Fed and the economy have performed over the last year. Perhaps there is more than a little Chuck Yeager in our Fed Chairman Powell than many believed as the Fed will have a “good landing” and with even a little luck, the economy will “use the airplane the next day”!