ADAPTABLE SOLUTIONS TO HELP YOU PROSPER

Business Online and Mobile Banking

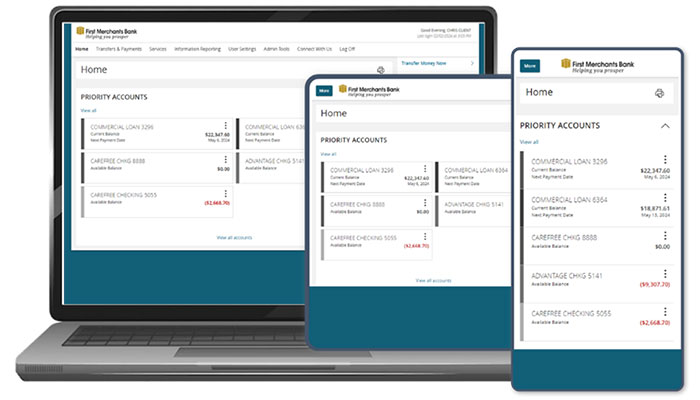

With our enhanced mobile and online banking experience, you can stay on top of all your transactions wherever you are.

Helping Your Business

You use online and mobile banking differently for your business than for your personal accounts. We built your new solution with your business in mind. Experience enhanced functionality that makes safely managing your business easier – on any device.

Easy Money Management

Manage your business finances from anywhere and on any device with a dynamic customizable homepage, full-service mobile banking app, eStatements, and adaptable alerts to keep you in the know.

Optimize Efficiency & Manage Cash Flow

Tap into tools that help you manage payables, receivables, and liquidity—like zero balance accounts, overdraft protection, and sweeps.

Safe & Secure Banking

Protect your business with fraud mitigation tools like alerts, authentication, account reconciliation, and our Positive Pay Suite to confirm check and ACH payments.

New to online banking and need the app?

Our new online and mobile banking solution expands functionality to give you full and secure access to your accounts no matter where you are. If you haven’t tried online and mobile banking for your business before, now is the time to check it out!

Quick Start Guides

Let us assist you with your banking needs.

Do you live for step-by-step directions—our Quick Start Guides are here for you!

How To Videos

Seeing is believing… or helpful.

Are video tutorials more your style? We’ve got your back.

Training on Demand

How To Videos

- Alerts How To Video

- Dashboard How To Video

- Information Reporting How To Video

- Making ACH Payments How To Video

- Making Wire Payments How To Video

- Multiple-Account Transfers

- Positive Pay How To Video

- Recipient Management How To Video

- User Management How To Video

- User Role Management How To Video

Learn about your new online banking solution!

Looking for additional resources, including FAQ’s regarding your transition to the new solution? Here is the information you need to know.

FAQs & Help

Questions about the new solution? Chances are, you’re not the only one! Here’s the help you need.

Yes, under the “Money Movement” option, choose “Loan”. Click the loan account you wish to pay and select an action from the payment options on the right of the screen.

Transaction Limits are as follows: $10,000 for single payment, $20,000 daily limit.

Account to Account Transfers will be posted as pending transactions when initiated. Transfers initiated prior to 9 p.m. ET will be effective the same business day. Transfers initiated after 9 p.m. ET will be effective the next business day.

Checking, Savings, Loan and CD accounts are available on Business Online Banking.

Yes, Online Banking allows you to view the front and the back of each deposit ticket. If you would like images of your deposited items please contact a Treasury Management Officer for further details on positive pay, remote capture or other business receivables solutions.

If the phone number(s) presented are not valid, please contact Treasury Solutions at 1.866.833.0050 to update your phone number(s).

The One-Time Security Code will be required the first time you log in to the system and each time you log in with a different device. You will be prompted to initiate a phone call or text and receive a one-time code that you will input to access the system.

- We recommend using the Phone option the first time you log in. Select a phone number and click Continue. The system will display a code that you will provide either verbally or with your phone's keypad when the call is received.

- If you choose the Text message option, you will enter the one-time code in Business Online Banking that will be sent in a text from Short Code 86434.

From firstmerchants.com, select Business Online Banking from the dropdown menu in the login box to begin the login process. If you’re using a mobile device, you’ll see mobile login options as well.

The “Contact Us” feature under the Administration tab allows you to send/ receive secure messages to/from the bank. You can submit requests to add or delete accounts, maintenance, photocopy requests, etc.

Many questions can be answered by clicking on the “How do I…”, “Terms”, or “FAQs” links at the bottom of each page or call Treasury Solutions at 1.866.833.0050 for assistance.

From firstmerchants.com, simply select the correct service from the sign in box’s dropdown menu. You’ll be taken to that service’s sign in page to begin the login process.

Business Online Banking is equipped with layered security and Out-of-Band Authentication to help mitigate both internal and external fraud. You are protected at login and when you initiate a transaction. Please visit our Security Center for additional information.

First Merchants Bank or any of its divisions, will not contact you via email, phone, or other means and request confidential information.

Up to 24 months of transaction history will become available in Mobile and Online Banking. You can access account history and search transactions with the filter function.

If you enter your password incorrectly three times, you will be temporarily locked out of your account. Please call Customer Service at 1-800-205-3464.

We recommend you bookmark www.firstmerchants.com to take full advantage of our integrated sign in box and to access the rest of our online content.