2023 OUTLOOK

2023 Outlook

IN 2022, WE WITNESSED TECTONIC SHIFTS in the geopolitical And macroeconomic landscape. Global central bank policies Dramatically shifted from highly accommodative to highly Restrictive. A hot war in europe and major attacks on Infrastructure have increased geopolitical tensions to The highest level in decades. Global energy supply maps are Being redrawn. A globalized world with ample financial Liquidity and low inflation has shifted to a world of resource Constraints and “nearshoring.”

As we look ahead to 2023, it’s important to understand several Important forces impacting the global economy and financial Markets at this particular juncture. Keep in mind, we are Still dealing with the policy response designed to contain The economic consequences of the covid-19 pandemic. In the Following outlook we’ll turn our focus to the key factors We believe will shape markets in 2023.

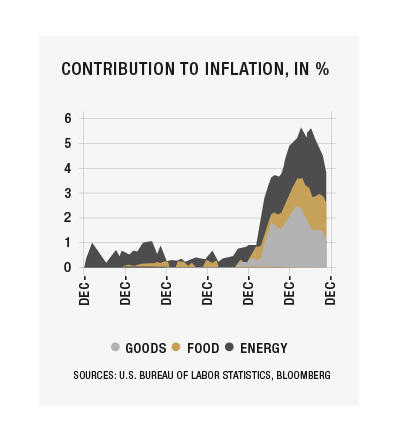

INFLATION

Taking a detailed look at inflation is fun, said nobody. But with this being at the heart of the policy reversal that caused so much upheaval, it’s arguably the most important economic statistic today. We believe inflation peaked in 2022 and will decline into 2023 but remain unconvinced the Fed will be able to achieve its policy target of 2% next year. Before we explain our reasoning, let’s remember that “inflation” is a single number that tries to capture the average price changes of everything purchased by the average consumer. Of course, we all know that some prices go up while others go down, and we all buy different things. For this reason, it can be helpful to dig a little deeper into broad categories of goods and services in order to better understand how inflation is behaving. We will look at four components of the Consumer Price Index (CPI): goods (21% of CPI), services (57% of CPI), food (14% of CPI), and energy (8% of CPI).

The acceleration in headline inflation during the pandemic was initially caused by excess demand for goods at a time global supply chains were constrained. (Consumers went shopping online with their “stimmie” checks.) We’re encouraged to see inflation related to the price of goods peaked in early 2022 in response to tighter policy and is now running at nearly half the level it was at this time last year.

The Russian invasion of Ukraine in early 2022 created a “supply shock” which caused food and energy prices to spike. Now that the initial shock is subsiding, food and energy prices stabilized and appear to have peaked in the third quarter of 2022. However, these prices are notorious for being highly volatile and could easily re-accelerate or decline sharply from current levels.

The services component of inflation continues to grow at elevated levels into late 2022. This is concerning because it is the largest category in the total “consumption basket” at 57% and tends to adjust more slowly than other categories. The primary category driving services inflation is shelter, which continues to grow due to the lagged effects of rapid home appreciation in recent years. We have reason to believe this should also peak soon in light of the challenges facing the housing market, but it will decline only slowly over the next year.

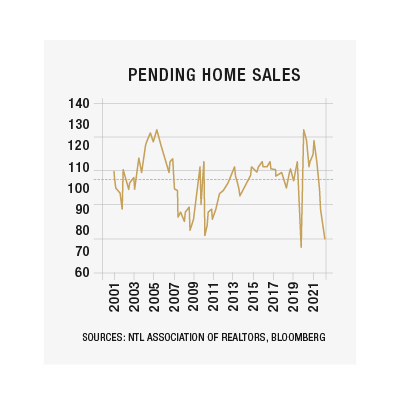

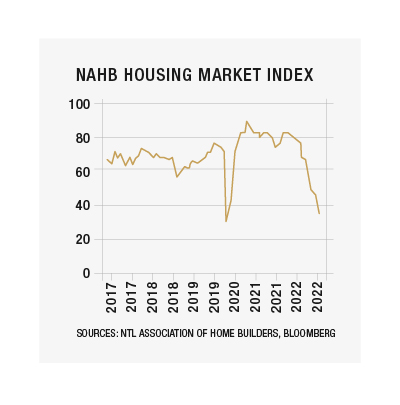

HOUSING MARKET

The S&P/Case Shiller house price index climbed over 45% from January 2020 to June 2022. A powerful combination of low interest rates and policy stimulus had combined to create a red-hot housing market. But now that economic conditions have reversed, the housing market has stopped in its tracks. As mortgage rates climbed from under 3% to over 7% in 2022, housing affordability and transaction volumes have collapsed, and the monthly supply of inventory has skyrocketed.

With that, home prices appear to have peaked and will likely decline into 2023, which should bode well for inflation (think shelter inflation, the primary component of the services category). Slower growth in the construction sector may also provide some relief in the labor markets.

LABOR MARKETS

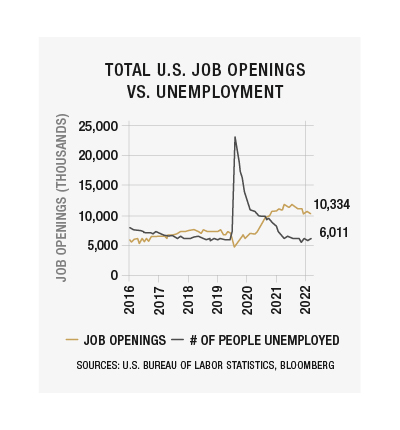

Despite the catastrophic jump in unemployment during the COVID-19 pandemic in 2020, the U.S. labor market reacted swiftly to the policy measures and posted the quickest recovery on record. At the end of 2022, the unemployment rate declined to 3.7% and there’s a scarcity of workers. In fact, there are over 4 million more job openings than there are unemployed persons. The strong economic recovery has contributed to these conditions, but there are also demographic factors which have impacted the supply of labor.

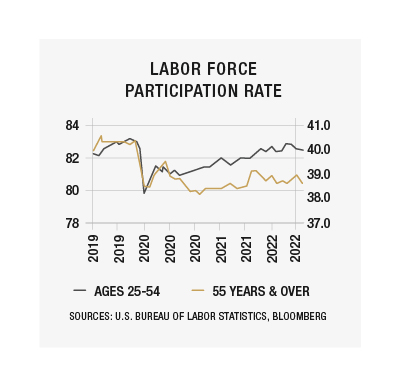

Following the pandemic, workers in the 25-54 age bracket swiftly returned to the labor force. However, workers ages 55+ left the workforce during the pandemic and never fully returned. Perhaps concerns about the virus kept at-risk people from going back to work, and many may have opted to retire early.

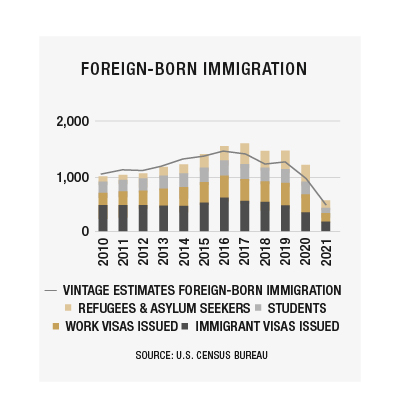

Another factor impacting tight labor markets has been a sharp drop-off in new immigrants in recent years. Border closures during COVID-19 and restrictive immigration policies have resulted in a diminished supply of foreign-born workers.

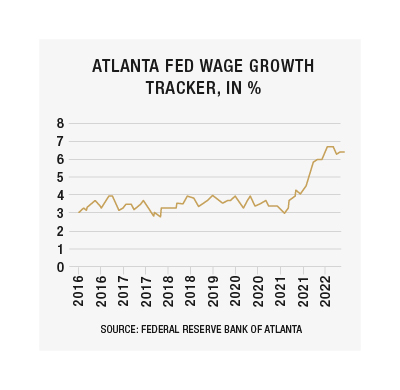

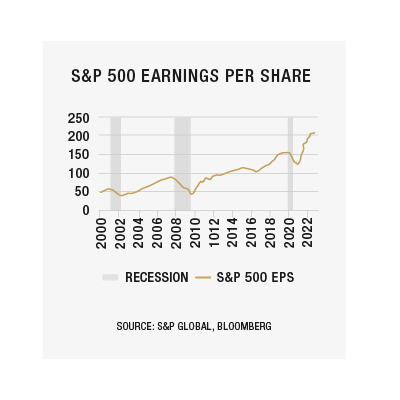

This environment of low unemployment and a constrained labor force has caused wages to accelerate since 2021. The Atlanta Fed’s Wage Tracker index suggests annual wage growth is currently running at nearly 6.5%. Although we expect these conditions to soften in 2023, the labor market will continue to put upward pressure on inflation and downward pressure on corporate earnings.

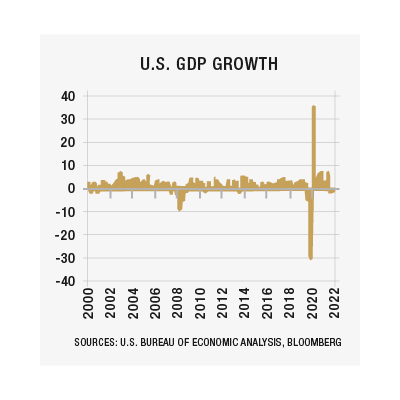

ECONOMIC GROWTH

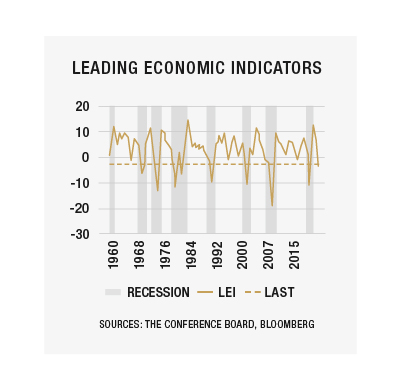

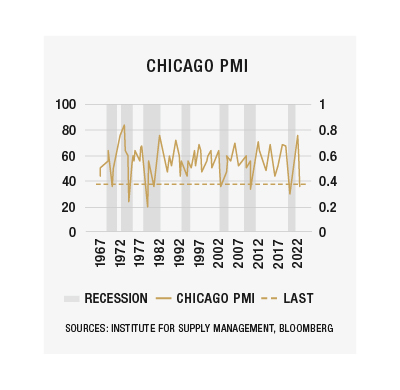

Tight fiscal and monetary policies designed to curb inflation have diminished growth prospects, and several indicators now point to heightened risk of recession in 2023. The Index of Leading Economic Indicators, for example, is currently at a level consistent with every recession going back to 1970. The Chicago Purchasing Managers Index (PMI) is also in recession territory.

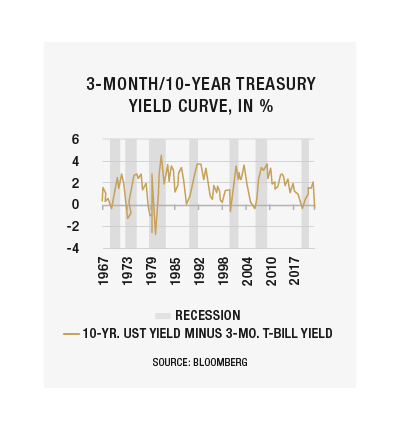

Likewise, if we turn to the U.S. Treasury market, we can see that the 3-month T-bill currently has a higher yield than the 10-year Treasury, which is known as an inverted yield curve. This suggests the market expects future interest rates to be lower than the prevailing rates – yet another recessionary signal.

Although the evidence points toward increased risk of recession next year, we may be talking about semantics. If the economy posts slightly positive or slightly negative growth in coming quarters, the fact remains growth will be weak whether we call it a recession or not.

INTEREST RATES

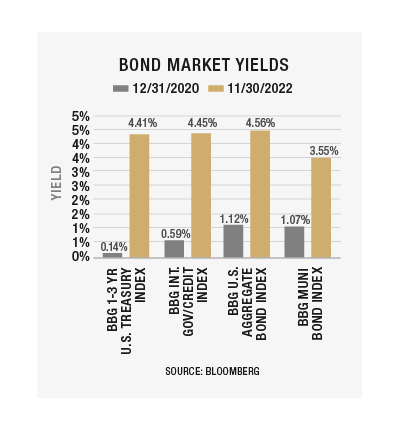

In 2022, the Federal Reserve and other central banks implemented a sharp policy reversal and aggressively increased interest rates. This, in turn, caused bond prices to collapse and post one of the worst bond-market returns on record. As noted earlier, the yield curve is now inverted (longer dated bonds have a lower yield than short-term bonds) and this implies the market is expecting the Fed (and other central banks) to cut rates soon after the tightening cycle ends.

We expect the Fed will stop raising rates by next summer, but we’re not so sure the Fed will cut rates before the end of 2023.

With higher yields, the bond market is now offering the best forward-looking expected returns in many years. Long-term investors would do well to review their portfolio and ensure cash on the sidelines is reinvested in the bond market to achieve their full target allocation.

EQUITY MARKETS

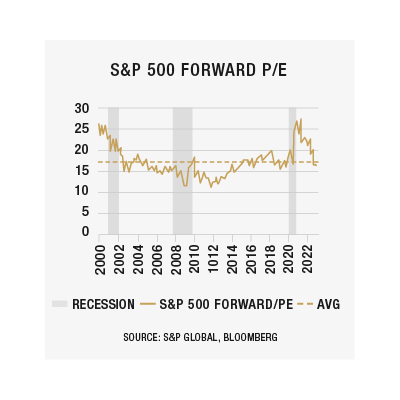

Equity markets around the world corrected sharply in 2022 in response to shifting macroeconomic conditions. It should be noted that most of the price correction was due to valuations returning to historical average levels from the lofty valuations at the start of the year. For the most part, companies with the most egregious valuations at the beginning of the year suffered the greatest price declines. This dynamic has led U.S. equity markets to be mostly fairly valued at the end of 2022, with some foreign markets now undervalued relative to historical averages. However, we remain cautious on the outlook for corporate earnings in 2023 considering the higher risk of recession next year.

Despite higher levels of macroeconomic uncertainty, our team continues to identify high-quality businesses with sustainable competitive advantages that will allow them to earn high returns on invested capital for the foreseeable future with lower chance of disruption. We also look at management’s track record of capital stewardship and focus on the strength of the balance sheet to avoid businesses with excessive amounts of leverage. We believe thorough assessment and ongoing monitoring of these factors helps to manage downside risk.

CONCLUSION

In many ways, 2022 was a challenging year for the economy and financial markets, and risks remain elevated as we head into the new year. Having said that, we are also seeing many positive developments that must be noted.

The monetary policy cycle that caused so much havoc is closer to the end than the beginning, and we expect the Fed will reach its target interest rate of 4.75% to 5.00% by next spring. Consequently, this is becoming an attractive entry point for long-term investors in the bond market. Also, speculative excess has been squeezed out of many markets as excess liquidity has been drained from the economy. The days of “easy money” gained from speculative investments with financial leverage borrowed at low rates is over (for now), and investors will once again focus on fundamentals. These are the same fundamentals at the core of our investment philosophy, which we’ve been keeping an eye on since day one.