Equities continued to rally sharply higher last week despite relatively disappointing earnings results from several of the tech giants that carry large weights within the U.S. equity market. The S&P 500 surged by 3.9% last week and closed out October with an 8.9% increase. All economic sectors logged gains last week except for the communication services sector that was weighed down by Alphabet and Meta (the parent companies of Google and Facebook), which tumbled after reporting earnings that showed a sharp deceleration in advertising revenue against rising operating expenses. Big tech in general has disappointed this earnings season as Tesla, Amazon and Microsoft also sold off on disappointing results, though Apple managed to buck the trend with better than feared results that sent its shares up 7.6% on Friday.

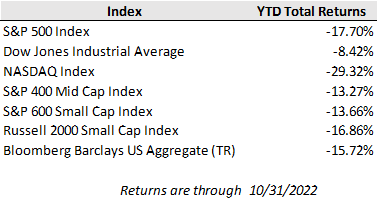

The Dow Jones index, which doesn’t include Alphabet and Meta and has lower technology exposure in general, recorded a 14.5% return for October, which was its highest monthly gain since 1976. Meanwhile, the tech-heavy Nasdaq Composite’s returned just 5.0% in October. The relative performance of the two indices epitomizes the reversal in fortunes over the past year of higher dividend value stocks over the high-flying growth stocks that benefitted from falling interest rates in years past. The popularly referenced FAANG stocks (Facebook, Apple, Amazon, Netflix, & Google) have collectively lost $3.3 trillion in market capitalization this year, a 32% decline compared to the S&P 500’s 18% year-to-date price drop.

With quarterly results for over half of the S&P 500 members in the book, third quarter corporate earnings are on pace for somewhat lackluster growth compared to the high bar set a year ago. According to FactSet, the constituents of the S&P 500 in aggregate are on track for a solid 9.5% increase in sales for the third quarter compared to the year prior, but that is translating to just a 2.2% increase in earnings as profit margins compress in the face of cost inflation, tightening financial conditions, and foreign exchange headwinds. Excluding the energy sector, where earnings are on pace for a 135% year-over-year increase, S&P 500 earnings growth would actually be down by about 5% compared to a year ago.

However, there have also been several upbeat themes throughout earnings season that have been powering earnings stamina in the face of a difficult economic backdrop. Some of the bright spots being highlighted include sustained pricing power to pass on cost pressures, consumer resilience supported by strong balance sheets and employment prospects, and robust spending on services, especially travel, leisure, and hospitality.

On the economic front, U.S. real economic output increased by a better-than-expected annualized rate of 2.6% in the third quarter, according to last week’s initial GDP release. Positive economic growth is a welcome result after back-to-back declines in the first and second quarters this year, though this growth looks a bit fragile. Consumer spending growth remains in positive territory with a 1.4% increase on the quarter supported by service spending that more than offset declining goods consumption. However, the housing market is being hit hard by rate increases as shown by a 26.4% decline in residential investment following last quarter’s decline of 17.8%.

The sharp drop in housing activity confirms that the Federal Reserve’s efforts to tighten financial conditions are having the desired effect, but strength elsewhere in the economy, such as the tight labor market, that continues to underpin inflation also demonstrate that the central bank’s job is not complete. With that context, the Federal Reserve will announce the next step in its policy plans on Wednesday. It is widely anticipated that the Fed will announce a 0.75% rate increase that will bring the short-term rate target to 3.75% to 4.00%. However, market participants will be listening keenly for the direction on future rate increases to see if a step down in the size of future hikes is in the cards starting in December.