At the highly anticipated Jackson Hole economic conference on Friday, Federal Reserve Chairman Jerome Powell said that he and his fellow central bank policymakers were determined to bring down inflation even if it led to “some pain” for households, businesses, and investors in the short-term. The comments were the clearest sign yet from Powell that the Fed plans to continue raising interest rates for the foreseeable future.

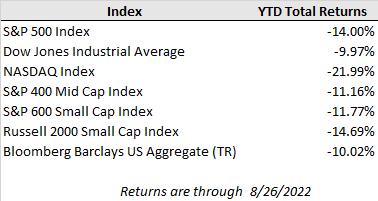

Powell’s words shook the markets. The S&P 500 fell nearly 3.5% on Friday, its worst one-day showing since June, and seemed to end the summer rally that moved stocks up nearly 20% in two months. The Dow and Nasdaq averages slumped between 3%-4%, sending risk-off signals to other sectors and asset classes (Bitcoin fell below $20K for the first time since early July). Bond markets have also been volatile with the yield on the two-year Treasury note pushing to a 15-year high today of over 3.4% as the market prices in higher rate hike expectations (with the Fed funds rate now forecasted to hit 3.75% to 4.0% by year end).

Last week’s July PCE inflation report reinforced encouraging recent signs of moderating price growth. However, previous instances of slowing inflation momentum over the past year have unexpectedly moved back to acceleration. The Fed needs much more conclusive evidence of price stability than just one month of data. Still, slowing price pressures were broad across most categories in this report and can give the Fed some temporary relief that its tightening is having an impact on inflation. The Fed will see one more month of inflation data, the August CPI, before its September meeting.

Sentiment may remain down this week. September has traditionally been the worst month for the S&P 500 Index, with an average loss since 1945 of 0.6%. Economic reports due this week include updates on consumer confidence, construction spending, and vehicle sales, which all arrive before the August jobs report on Friday. The U.S. jobs report for August is expected to show 300K jobs adds for the month and an unemployment rate that holds steady at 3.5%.

The hopes for a “soft landing” have hit some turbulence with the more aggressive tone from the Federal Reserve. However, the labor market and corporate earnings, while cooling, have yet to show major cracks from the increased pressure. Higher input costs will likely weigh on profit margins in coming quarters, but to this point corporations have been able to pass on cost increases and maintain margins well above historical levels (the S&P 500 net margin for the last 12 months ending in June was 12.9% compared to a 20-year average of 9.2% according to FactSet). But excess stimulus savings are winding down, and it will be up to continued strength in the labor market to help consumption stay afloat. If inflation continues to decelerate before the labor market outlook sours, the Fed can ease off the brakes before inflicting longer term damage.

We would caution investors against making reactionary investment decisions in response to the recent turbulence, particularly when little new fundamental information has been gleaned. As always, we are here to help navigate the risks and opportunities of these uncertain times and we will keep you apprised of the trajectory of inflation and economic growth in the months ahead. Please don’t hesitate to reach out to your advisor with any questions or concerns.