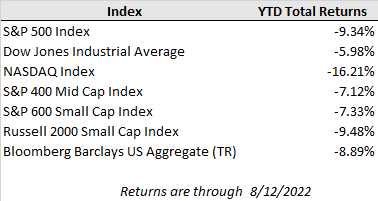

Stocks notched their fourth straight winning week with gains Friday after the monthly report from the University of Michigan showed a pop in consumer confidence, marking the second consecutive gain for the index since June. The positive sentiment data, coupled with a better-than-expected reading of the consumer price index earlier in the week, had some traders feeling that the worst inflation had passed and that the Federal Reserve might raise the federal funds rate by just half a percentage point in September, after two consecutive three-quarter-point increases. For the week, the S&P 500 rose 3.3%, while the Dow Jones and Nasdaq logged gains of 3.0% and 3.1%, respectively.

Last week’s consumer and producer inflation reports showed encouraging signs of decelerating price growth beyond expectations as easing commodity prices, especially energy, and retailers marking down prices on excess inventory had a large impact. For July, the consumer price index (CPI) was flat compared to June while the producer price index (PPI) fell 0.5% for the month, compared to consensus forecasts for both indices to increase 0.2%. The PPI drop was the first since April of 2020. On a year-over-year basis, the PPI growth slowed from 11.3% in June to 9.8%, while CPI growth cooled from 9.1% to 8.5%. The reports were undoubtably a step in the right direction and helped sustain the recent market rally, but the year-over-year growth rates remain much too high across the board for the Federal Reserve to start easing off the policy brakes just yet.

Overseas, China lowered two key lending rates and pushed more cash into its economy today as it looks to keep stimulating the economy in the face of deteriorating growth data. The country remains the outlier in its policy stance, with the rest of the major economies tightening to tame inflation. The People's Bank of China cut its one-year lending facility rate by 10 basis points to 2.75% and cut the seven-day lending rate the same amount to 2%. China policymakers are still clearly worried that risks are still to the downside with the ongoing strict COVID policies and continued weakness in housing, even though liquidity is stoking inflation pressures.

Russia’s continued attack on Ukraine has shifted toward the southern side of the country, where fighting is continuing around the Russian-controlled Zaporizhzhia nuclear station, Europe’s largest. That is stirring concerns about a radiation risk far beyond Ukraine. The U.S. and the European Union have called for the creation of a demilitarized zone around the plant.

In the week ahead, investors will get a good look at U.S. consumer strength with July retail sales to be released on Wednesday and earnings reports from major retailers throughout the week. Retail sales are expected to be weak, though the 0.1% consensus is stronger than the 1.0% reality in June because inflation rose 1.1% in June and was unchanged in July. As a result, real retail sales were down a tenth in June and are projected to be up a tenth in July. Still, retail sales ex-autos and gas and the retail sales control group are expected to slow. Also on the calendar are earnings reports from Home Depot, Lowes, Target, Walmart, and Macy's. Looking at the road ahead, Federal Reserve members will meet in Jackson Hole at the end of August and have a new inflation and jobs reports to digest before deciding whether to pull the trigger on a 50-point or 75-point rate hike at the September meeting.