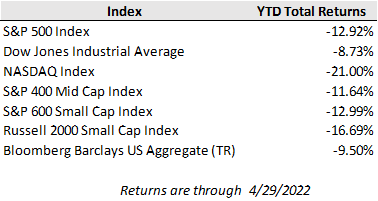

U.S. equity markets broadly tumbled to their worst levels on the year last week as earnings results from several tech heavyweights fell short of expectations and bond yields crept higher ahead of this week’s Federal Reserve meeting. Earnings misses from Amazon and Google-parent Alphabet and disappointing forward guidance from Apple on supply disruption weighed on sentiment and weekly returns given their large weightings and influence on market indices. For the week, the S&P 500 lost 3.3%, bringing its year-to-date slide to -13%, while the Dow Jones ceded 2.5%. The tech-heavy Nasdaq Composite entered bear market territory, down 23% from its highs, following a 3.9% drop last week. Meanwhile, bond yields are threatening to push to new cycle highs as the 10-year U.S. Treasury yield hit 3.00% for the first time since 2018, doubling off its year end level of 1.50%, though it has struggled to push beyond that mark.

The recent bond yield back-up has pushed long-term rates beyond future inflation expectations for the first time in over two years. This dynamic has fed into the recent equity sell-off as improving real bond yields could start to attract investment flows away from equities after years in which falling real bond yields pushed more investors into equities. Higher rates also reduce the present value of future cash flows for stocks. In response, global equity markets have seen three consecutive weeks of net outflows amounting to $31.6 billion, according to a report from Bank of America, reversing strong momentum since the start of 2021 during which time global equities logged record net inflows totaling $1.1 trillion.

Despite the recent pullback in valuations and numerous macroeconomic challenges, U.S. corporate earnings have continued to grind higher compared to last year’s strong earnings and provide positive support for stocks. With over half of the S&P 500 having reported first quarter results so far, the index is on track for a 7.1% increase in earnings year-over-year for the first quarter (beating expectations for 4.7% growth at quarter end) on sales growth of 12.2%, according to FactSet. Earnings growth would be even higher excluding the results of Amazon, which reported a $3.8 billion net loss in the first quarter driven largely by an unrealized non-operating valuation adjustment in its stake in electric vehicle maker Rivian. Excluding Amazon, the aggregate earnings growth for the S&P 500 improves to 10.1%.

Corporate earnings growth in the first quarter contrasts somewhat with slowing economic growth data. The first preliminary reading of U.S. GDP for the quarter reported in a 1.4% contraction compared to expectations for a 1.1% rise. Economic output was supported by strong final demand by consumers, albeit moderating, but an import surge and negative contribution from inventories pulled down reported growth.

Regardless of the dip in reported economic growth and moderating consumption trends, the Federal Reserve is set to hike interest rates by 0.50% and announce the start of a reduction of its balance sheet at this week’s FOMC meeting. April employment results will be announced on Friday but inflation has become the core focus of the Fed (and thus the main focus of market participants also) with the labor market running at ultra-tight levels. April’s consumer price index update will be announced next week. Inflation growth has started to show signs of peaking, but then the question will turn to the pace of the decline as inflation needs to come down notably before the Fed can start to ease off the brakes.