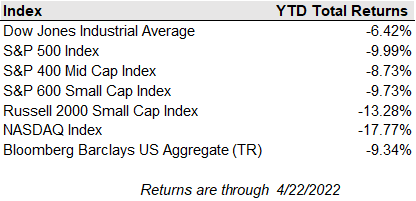

The Dow Jones average suffered its worst drop since October 2020 on Friday, capping a fourth straight weekly decline, as mostly positive earnings reports failed to ease fears of rising inflation. Friday's nearly 1,000-point drop in the Dow followed a speech by Fed Chairman Powell on Thursday that signaled support for a 50-basis point rate hike. Rates jumped on Powell's remarks before the 10-year yield eased slightly on Friday to about 2.9%. Last week the Dow finished down 1.9% in its ninth losing week of the last 11, while the S&P 500 dropped 2.8% and the Nasdaq fell 3.8%.

Tech earnings will be pushed into the spotlight with Apple, Amazon, Microsoft, Alphabet, Meta Platforms, and Intel all reporting. The earnings season so far has been somewhat balanced between some strong results (think Tesla) and big disappointments (think Netflix). While the economic calendar includes updates on new home sales, durable goods orders, pending home sales, GDP, and trade balance - the focus may be on Federal Reserve expectations. Bank of America believes the Fed will hike 50 basis points at the next three meetings and 25 points thereafter until the fed funds rate reaches 3.50% in May of 2023. Nomura Securities stressed the market Friday with a prediction for 75-basis point hikes at the June and July FOMC meetings after a 50-basis point increase in May.

U.S. Defense Secretary Lloyd Austin and Secretary of State Antony Blinken met with Ukrainian President Zelensky to discuss military aid to Ukraine. Russia has been attacking Ukrainian railways in attempt to block the flow of heavy weapons from the US and other allies to Ukraine’s military. Despite the attacks Austin is confident that Ukraine can win the war if given the support and equipment. So far, the U.S. has contributed $3.4B in defense support and has placed financial sanctions on Russia.

While inflation, rising interest rates, and tech earnings have the market’s attention, we should not forget the large cash balances held by US consumers and companies. Elon Musk purchased Twitter for $44 billion. According to FactSet, S&P 500 companies have added $600 billion to their balance sheets since 2019 (an increase of almost 50%). With volatility in equity markets, expect these companies to make strategic acquisitions and share repurchases. While near term volatility can be unnerving, we believe it is a buying opportunity for long-term investors. Please reach out to your wealth advisor if you have any questions.