The S&P 500 closed out the trading week on a positive note through all the volatility that took place. The S&P 500 Index is down 8% from its all-time high and is down 7% for the month of January in a market full of volatility. Investors head into the week facing big earnings reports from Alphabet, AbbVie, Amazon, Ford, and Starbucks. This week will have over 100 S&P 500 companies scheduled to report earnings. Amid significant volatility, the fourth quarter earnings season has been decent by most accounts. So far, 33% of the S&P 500 companies have reported results with over 70% exceeding consensus earnings and sales estimates, according to FactSet.

The economic calendar for this week also includes the January jobs report, which could surprise due to the large number of hourly workers who were stopped by Omicron quarantines during the month. The unemployment rate is expected to hold around 3.9%. In the energy market, the OPEC+ meeting will be watched closely with supply and demand factors in the spotlight. At the very end of the week, the Winter Olympics in Beijing begin.

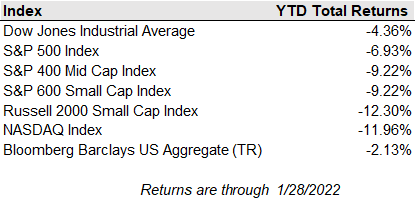

The NASDAQ has been the primary year to date laggard, down 11% for the year and 15% from its highs. This has been driven by a hawkish Fed as detailed in our last weekly commentary. However, this near-term bear market may be close to a bottom. Nasdaq’s 14-day Relative Strength Index (RSI) touched 10. RSI is an indicator that measures the magnitude of price movements. Typically, a RSI over 70 indicates the asset is overbought and a RSI below 30 indicates that it is oversold. Nasdaq’s RSI has touched or dropped below 10 only two times since 2010 (see chart below). Those two times were 7/6/2010 and 5/17/2012, periods in which the NASDAQ posted returns of 12% and 8% in 90 days following and 35% and 24% in one year, respectively. While short-term volatility may be difficult to stomach, we are focused on a long-term approach to assure your portfolio is aligned with your long-term goals. Selloffs in well-managed businesses with strong cash flows and completive advantages are buying opportunities for the reasoned, long-term investor. Please reach out if you have any questions around the market or our long-term approach.