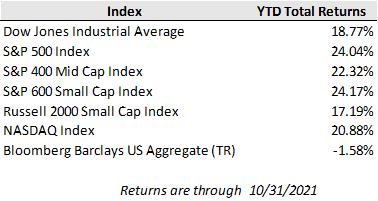

U.S. equities broadly pushed to new highs last week and closed out October with strong gains as third quarter corporate earnings continued to highlight a robust demand environment despite numerous supply constraints. For the week, the S&P 500 added 1.4%, bringing its October gains to 7.0%, which more than made up the ground ceded in September’s volatility. Meanwhile, the Dow Jones gained 0.4% and the tech heavy Nasdaq climbed 2.7% last week, aided by a drop in long-term interest rates as the market assesses the Federal Reserve’s shift away from a very accommodative policy stance.

While the broad equity market has pushed higher so far through third quarter earnings season, it has been a more volatile picture at the individual company level given the higher level of uncertainty from supply chain disruption. Overall, the S&P 500 is on track for nearly a 37% earnings growth rate for the third quarter compared to a year ago, which beats the 30% growth forecast at the outset of the season. However, forward looking guidance is skewing negative as companies moderate their sales and earnings expectations, despite continued strength in demand, due to labor and supply chain challenges.

Even the tech heavyweights, which have generally seemed less susceptible to broader economic challenges, have not been immune. Last week, Apple announced that it had fallen short of quarterly revenue expectations for the first time since 2017 as supply issues like the chip shortage posed a $6 billion headwind to sales, and management anticipates those headwinds will be worse in the fourth quarter. Amazon, who also reported last week, fell short of earnings expectations as higher cost pressures ate into its operating profit margin. Equity markets moved higher despite the weakness in these influential businesses.

On the flip side, not all company forward guidance was downbeat. Auto manufacturers, including Ford and General Motors, whose businesses have acutely felt the strain from the global semiconductor shortage, actually noted that while chip availability remains a challenge, it improved markedly during the third quarter. Their management teams anticipate further improvement during the fourth quarter and throughout 2022. This improvement coincides with a notable drop in Covid-19 cases in Southeast Asia, which plays a crucial role in the global chip manufacturing process and has been a key bottleneck due to lockdowns. Daily new cases in Malaysia, Vietnam, Indonesia, and the Philippines have fallen by half since the start of September and restrictions have started to ease as a result.

In the week ahead, all eyes will be on the Federal Reserve with an important monthly meeting. In response to improving employment and elevated inflation, the Fed is expected to announce that it will begin tapering its monthly bond purchases (currently totaling about $120 billion each month) likely ending in June 2022. The central bank has indicated that it is unlikely they would discuss raising rates until this process is complete, though the market has priced in a high expectation for at least two 0.25% rate hikes next year. The October employment report is also due out on Friday with a consensus forecast for 425k jobs added to the U.S. economy last month.