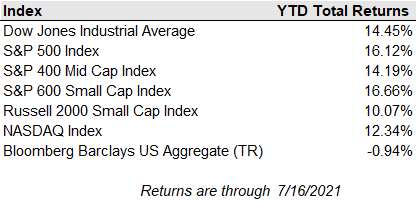

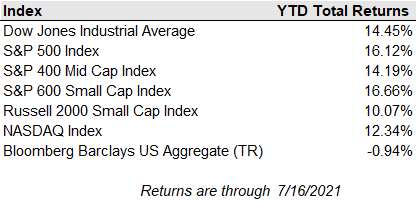

U.S. equities fell last week despite strong bank earnings and June retail sales. For the week, the S&P 500 was down 0.97%, the Nasdaq down 1.87%, and the Dow Jones down 0.52%. Meanwhile, long-term interest rates have tumbled in recent weeks with the 10-year Treasury yield falling to 1.21% as of Monday morning July 19, down from 1.5% a month ago and the first quarter high of 1.75%. All major groups in the S&P 500 have retreated, led by commodity, financial and industrial companies. See below for a list of major indexes and their year-to-date total returns.

Recovery from the pandemic has and will continue to be very different around the globe. Uncertainty around the COVID-19 variant have dampened the global macroeconomic outlook, and we are starting to feel its impact in the states. Los Angeles County restored their indoor mask mandate, as they recorded 1,000 new cases each day for a week. There is increasing concern about COVID and the Delta variant in the emerging markets where widespread vaccination is still a long way in the future. The strong stock rally may be tested if further travel restrictions are implemented. In addition, Chinese growth continues to show signs of struggling. This week there may be a distinct “risk-off” mindset or a flight to safer securities in the global markets. Many investors may begin to wonder if they can justify holding some stocks with stretched valuations if the economic recovery isn’t as robust as previously thought.

Consumer inflation continues to run hot as supply bottlenecks and heavy re-opening demand push prices higher, pushing US core CPI in June up 5.4% YoY. Higher inflation (and how temporary some price increases prove to be) will be primary concern as the Fed decides monetary policy in 2H 2021 and 2022. Numerous economists say the Fed is miss-judging how persistent inflation will be, but there continue to be numerous experts on both sides of the inflation debate.

This week is full of earnings with spotlights on Netflix, Coca-Cola, Johnson & Johnson, and Honeywell. United Airlines also reports which will provide insight to how travel has recovered. We will see if earnings can continue to beat expectations and push stocks higher despite inflation and COVID-19 fears.

Bill Ackman’s SPAC, Pershing Square Tontine Holdings, dropped its deal to buy 10% of Universal Music. Ackman sited issues raised by the SEC with several elements of the transaction for the reason of the drop and will now be pursuing a “conventional” SPAC merger. This shows that as SPACs keep arising, managers have been seeking unconventional deals, which might indicate the “good” conventional deals are few and far between.

Recovery from the pandemic has and will continue to be very different around the globe. Uncertainty around the COVID-19 variant have dampened the global macroeconomic outlook, and we are starting to feel its impact in the states. Los Angeles County restored their indoor mask mandate, as they recorded 1,000 new cases each day for a week. There is increasing concern about COVID and the Delta variant in the emerging markets where widespread vaccination is still a long way in the future. The strong stock rally may be tested if further travel restrictions are implemented. In addition, Chinese growth continues to show signs of struggling. This week there may be a distinct “risk-off” mindset or a flight to safer securities in the global markets. Many investors may begin to wonder if they can justify holding some stocks with stretched valuations if the economic recovery isn’t as robust as previously thought.

Consumer inflation continues to run hot as supply bottlenecks and heavy re-opening demand push prices higher, pushing US core CPI in June up 5.4% YoY. Higher inflation (and how temporary some price increases prove to be) will be primary concern as the Fed decides monetary policy in 2H 2021 and 2022. Numerous economists say the Fed is miss-judging how persistent inflation will be, but there continue to be numerous experts on both sides of the inflation debate.

This week is full of earnings with spotlights on Netflix, Coca-Cola, Johnson & Johnson, and Honeywell. United Airlines also reports which will provide insight to how travel has recovered. We will see if earnings can continue to beat expectations and push stocks higher despite inflation and COVID-19 fears.

Bill Ackman’s SPAC, Pershing Square Tontine Holdings, dropped its deal to buy 10% of Universal Music. Ackman sited issues raised by the SEC with several elements of the transaction for the reason of the drop and will now be pursuing a “conventional” SPAC merger. This shows that as SPACs keep arising, managers have been seeking unconventional deals, which might indicate the “good” conventional deals are few and far between.