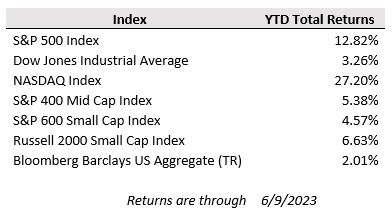

Following another week of modest market gains, the S&P 500 has officially rebounded over 20% off its October lows, an encouraging milestone for investors labeled as the beginning of a new bull market, though several hurdles remain in maintaining that momentum into the second half of the year. Last week’s economic data showed continued signs of cooling growth, including in the service sector and the labor market, which have been two of the key pillars of strength of U.S. economic resilience over the last few quarters. For the week, the S&P 500 rose 0.4% while the Dow Jones and Nasdaq Composite eked out gains of 0.1% and 0.3%, respectively.

Historically, crossing the bull market threshold has been a positive indicator of further upside ahead for equity markets as the S&P 500 has posted positive gains 92% of the time in the 12 months following that threshold, according to Bank of America. The rally to date has been underpinned in part by growing confidence in the potential for a soft landing, wherein inflation continues to decline toward the Federal Reserve’s 2% target without the economy falling into recession.

However, perhaps the most defining feature of the equity market rebound so far has been its concentration to just a handful of stocks, primarily mega-cap technology companies that are seen as large beneficiaries of booming interest in the potential of artificial intelligence. As of Friday’s close, the top 10 stocks in the S&P 500 have generated a total return of 44% year-to-date compared to a return of less than 3% for the index excluding those 10 stocks. Those 10 stocks now sit at richly valued levels selling at roughly 32 times their expected combined 2023 earnings compared to the rest of the index that sells at a combined 17 times 2023 earnings. Performance will likely need to broaden out from today’s narrow participation in order for the positive market momentum to continue.

Last week’s economic news was headlined by an unexpected jump in weekly jobless claims, as unemployment insurance filings rose 28k to 261k, which is the highest level since October 2021. Meanwhile, the ISM Services PMI, an important gauge of business activity in the service sector, decelerated in May with the index falling to 50.3 from 51.9 in April as demand slowed and input cost pressures declined. Any reading over 50 is still considered expansionary, but the index has come down well off its highs of 67.6 from late 2021 and is now close to falling into contraction territory as the manufacturing sector has been in for the past 8 months.

These reports of moderating economic data increase the likelihood that the Federal Reserve will abstain from another rate increase at the June FOMC meeting that will finish up on Wednesday. Today’s May CPI report further boosted the odds of a pause as consumer prices came in less than expected at 4.0% year-over-year (+0.1% month-over-month) compared to April’s 4.9% growth rate and expectations of a 4.1% year-over-year increase. According to the FOMC FedWatch tool, markets now price in a 95% probability of no increase on Wednesday, though there is still expectation for another hike in July. This week’s inflation data, retail sales reports, and consumer spending survey will all be important data points for the Fed as they consider whether rates have hit their peak or need to come up further.