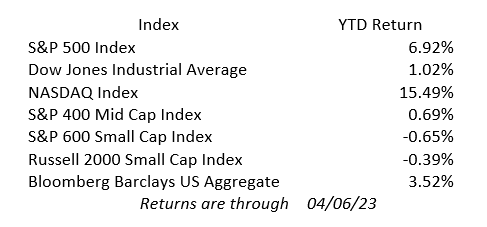

While last week was shortened due to the holiday, there was no shortage of economic information for investors to review. For the week the S&P 500 was up 1.38%, the Dow Jones Industrial Average was up 1.96% and the NASDAQ was up 0.62%. Mid-Caps and Small-Caps for the week dropped 0.84% and 0.82% respectively.

The banking sector showed signs of stabilizing last week. Overall US deposit outflows slowed and even started to reverse for smaller banks. Commercial bank lending contracted indicating a tightening of credit conditions for many reasons including higher interest rates and lenders requiring higher credit quality from borrowers.

The February JOLTS (Job Openings and Labor Turnover Survey) reported a 632k drop in U.S. job openings, which brought available jobs down to 9.93 million. It was the first time that openings fell below 10 million in almost two years. Available job openings had shown two job openings for every worker, but the latest figures bring that to less than 1.7 per worker. Continuing Jobless Claims came in at 1,823K, which was 128.5K higher than expected. Initial Claims came in at 228.0K, which was 29.0K over expectations. Despite these figures showing a softening labor market, Friday’s March employment report showed a still robust 236k increase in nonfarm payrolls, and the unemployment rate went down from 3.6% to 3.5%. Taken altogether, these numbers show a cooling job market but hiring conditions remain too tight for the Fed to shift course. The markets put a 70% chance of a 25-bps increase at the May Fed meeting.

US online prices declined for the seventh month in a row on an annual basis according to the Adobe Digital Price Index. The Adobe gauge analyzes one trillion visits to retail sites and more than 100 million items across 18 product categories. It models itself after the consumer Price Index, but only tracks online prices. March showed a 1.7% drop from a year earlier. The largest declines were seen in discretionary categories where consumers are being more careful with their spending. This reflects a more competitive marketplace online as well as positive movement toward the Federal Reserves fight to reduce inflation. While many online prices are dropping, products such as groceries remain high showing a 10.3% increase from a year ago.

The economic calendar is full for the remainder of this week. On April 12th, the CPI (Consumer Price Index) reports for March will be published along with Hourly Earnings for last month. The core CPI, ex-Food and Energy, is expected to be down slightly from the previous month, while the year-over-year numbers are expected to be up just a bit. Thursday brings the PPI (Producer Price Index) and Initial unemployment claims. Friday shows us Retail Sales along with Industrial and Manufacturing production and business inventories.