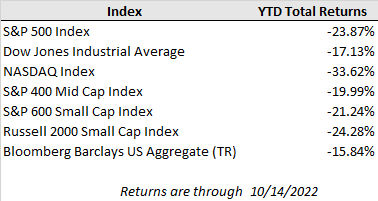

U.S. equities marked new year-to-date lows in turbulent trading last week as another upside surprise in inflation pushed rate hike expectations higher and investors digested cautious earnings updates from large banks. Following the inflation report, the 2-year U.S. Treasury yield pushed up to 4.50% from 4.30% a week ago, and the 10-year Treasury yield eclipsed 4.0% for the first time since 2008. For the week, the S&P 500 closed down 1.6% while the tech-heavy Nasdaq Composite tumbled 3.1% due to the headwind of rising interest rates and the index’s large semiconductor exposure that sold off on the announcement of new U.S. restrictions against sales of certain advanced chips and chip manufacturing equipment to China. The Dow Jones managed to hang on to a gain of 1.2% due to its lower tech exposure and interest rate sensitivity.

The September CPI report wasn’t pretty. The overall 0.4% month-over-month price increase in September well-exceeded economist expectations for just a 0.2% increase on the month, marking the 9th upside surprise in the last 11 monthly readings. On an annual basis, headline consumer price growth ticked down to 8.2% year-over-year from 8.3% in August, but core CPI (excluding volatile food and energy prices) accelerated to a 6.6% increase year-over-year, which is the highest core price growth in 40 years. Falling energy prices (energy commodity prices dipped 4.7% in September) continued to be more than offset by concerning trends in food (+0.7% in September) and core service prices (+0.8% in September). Rent expense (up 0.8% in September and 6.7% year-over-year) has been a key culprit in the recent core price acceleration as it accounts for nearly one third of the consumer price index.

Another upside surprise in inflation means another upside move in future rate hike expectations. Following last week’s CPI release, markets are now pricing in expectations that the Federal Reserve will hike short term rates to as high as 5.0% by the end of the first quarter next year, compared to a peak rate expectation of 4.50% at the end of last month or 4.0% at the end of August. Investors are now leaning toward two more 0.75% rate hikes before year end from the current fed funds target of 3.00% to 3.25%.

Last week also marked the beginning of third quarter corporate earnings season with several large financial institutions kicking things off. Their results generally indicated continued resilience in consumer and corporate credit activity, but the outlook commentary from management teams leaned cautious as big banks bumped up their loan loss reserves in the face of growing economic uncertainty. At this point, delinquency rates remain quite low and spending on services and staples is holding up on the back of strong consumer balance sheets. However, there were concerns that weakness in spending on big ticket items is starting to broaden as excess stimulus savings are winding down with wage growth broadly trailing inflation. Bank of America noted that average deposit account balances are still at multiples of pre-pandemic levels on the company’s third quarter earnings call, but “that extra money [consumers] have in their checking accounts will deplete probably by sometime midyear next year,” according to JP Morgan’s CFO Jeremy Barnum.

This corporate earnings season will be crucial in setting the expectations for 2023. Next year’s earnings forecasts have remained remarkably resilient to this point with aggregate forecasts for the S&P 500 constituents still indicating 8.0% earnings growth on the year. However, there are growing concerns that those expectations will need to be reset as corporate profit growth gradually succumbs to the gravity of economic weakness with the Fed slamming the policy brakes. The week ahead will begin to clarify the picture a bit with significant reports due out across sectors, including Bank of America (BAC), Johnson & Johnson (JNJ), Netflix (NFLX) and Procter & Gamble (PG) all on the docket.