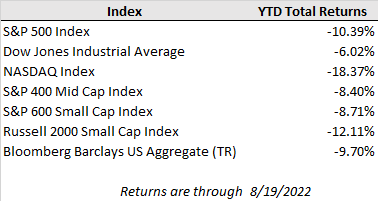

After a sharp rally up from mid-June market lows, the positive momentum in U.S. equities has cooled off in recent days as members of the Federal Reserve have pushed back against a growing narrative that the central bank may start easing back from restrictive policy near-term. For the week, the S&P 500 and the Nasdaq Composite fell 1.2% and 2.6%, respectively, while the Dow Jones ended roughly even on the week. The indices are under further pressure in this week’s early trading with growth stocks continuing to see the greatest volatility. Meanwhile, bond yields have crept higher with the 10-year Treasury yield breaking back above 3.0% (after touching as low as 2.6% to start the month) as expectations for the extent and duration of rate hikes have increased in recent days.

While recent inflation and labor market readings have shown a step in the right direction and helped ignite the market rally, there is a long way yet to go for inflation to come down before victory can be declared on regaining price stability. Fed member Neel Kashkari, who tends to be among the more dovish members of the committee, said last week, “the idea that we’re going to start cutting rates early next year, when inflation is very likely going to be well in excess of our target, I just think it’s unrealistic. I think a much more likely scenario is we will raise rates to some point and then we will sit there until we get convinced that inflation is well on its way back down to 2% before I would think about easing back on interest rates.”

Last week’s update on the health of the U.S. consumer showed real spending continuing to tread water as people are spending what they must to keep pace with inflation and no more. July retail sales overall came in flat compared to June, and June’s results were revised down from 1.0% to 0.8%. However, excluding autos and gas sales, July retail spending increased at a healthier 0.7% clip. Big retailers like Walmart and Target that reported quarterly earnings last week continued to discuss their efforts to work through large backlogs of overstocked goods inventory, including cancelling billions of dollars in orders and aggressively cutting prices on select products. They did note a positive impact in sales in recent weeks with the moderation in energy prices.

While U.S. inflation readings showed positive signs of cooling in July, inflation readings overseas in Europe weren’t as positive in showing progress of decelerating price growth. In particular, consumer prices in the U.K. surprised to the upside and accelerated to 10.1% year-over-year in July from 9.4% in June, while CPI for the E.U. held steady at 8.9% year-over-year. The readings not only pushed up interest rates in Europe, but they also added to upward pressure on rates here domestically as commodity shortages in Europe have ripple effects to global raw material markets. The energy situation in Europe will be crucial to monitor in coming months as Russia curtails natural gas supplies during preparations for winter.

In the week ahead, Federal Reserve Chairman Powell’s speech at the annual Jackson Hole symposium is expected to get the bulk of the attention as market participants seek to gauge the path of future policy changes. However, it is unlikely to settle the debate between a rate hike of 0.50% or 0.75% for the September Fed meeting with more inflation data due out ahead of the meeting.