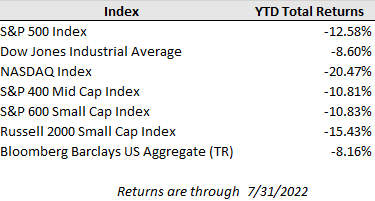

Equity markets surged higher last week, capping off the highest monthly returns since July of 2020, as future rate hike expectations slid lower following the Federal Reserve meeting and corporate earnings broadly continued to come in better than feared. For July, the Dow Jones gained 6.7%, while the S&P 500 added 9.1%. The Nasdaq rose 12.4%. Meanwhile, bond markets also rallied as the 10-year U.S. Treasury yield tumbled to 2.64% compared to 3.10% at the end of June as economic growth and inflation expectations have declined in recent weeks.

The inflation discussion will remain front and center in the coming days as investors await next week’s update on consumer and producer price growth in July. The Federal Reserve hiked interest rates by 0.75% last week, as anticipated, and Chairman Powell stated plans to be fully data dependent on determining the course of future rate hikes rather than providing forward guidance. According to the CME FedWatch Tool, the market has priced in expectations that rates will be hiked another 1.00% in the remaining three Fed meeting this year, bringing the Fed funds target rate to 3.25% to 3.5%.

Of note last week was the report of continued decline in US Gross Domestic Product. Falling GDP alone is not proof of recession, particularly in the context of a still strong labor market and personal income growth, but the GDP report raises concerns that the economy entered a recession in the first half of 2022. Recession is usually enough to stop the Fed from tightening, but as Chairman Powell explained in his press conference, when inflation is as high as it is now, the economy works to no one’s benefit. The thought process is that the fight against inflation is so important, it is not only worth risking recession, it is necessary to risk a recession. The consensus is that more rate moves will be needed to reduce inflation, but there is a difference of opinion on the speed with all eyes on the next FOMC meeting in September. This week’s labor market update will be the next important piece of information in the policy outlook.

The earnings calendar is full this week with 148 S&P 500 companies reporting earnings. Companies on the docket to report results include BP, Airbnb, CVS Health, Starbucks, and Caterpillar. Also of interest, Tesla holds its shareholder meeting this week at a crucial time for the electric vehicle maker.

Resumed grain shipments from Ukraine are moving forward. The Sierra Leone-flagged ship Razoni, carrying 26K tons of corn, departed Odesa at 9:48 am local time today, becoming the first vessel to leave the port since late February. A Russian naval blockade still threatens Ukraine's commercial sea routes, while missile strikes have targeted several ports, as well as the grain storage locations. Quote: "We are ready to export Ukrainian grain," Ukrainian President Zelenskyy said after his visit to the Black Sea. "It is important for us to remain the guarantor of global food security."

It is a big development for Ukraine, which has been traditionally referred to as the "Breadbasket of Europe", as well as many developing nations that rely on its grain across Africa, the Middle East, and Southeast Asia. It has also raised expectations that an international food emergency could be avoided, with prices spiraling upwards in recent months and adding to an existing inflation crisis. Besides freeing up grain that is currently stuck in Ukraine, there is another challenge of how to store or export the country's upcoming summer harvest, which is expected to yield an estimated 65M tons.