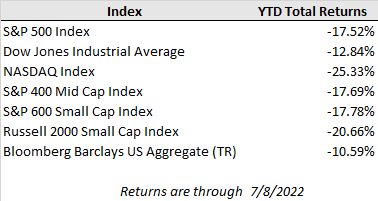

U.S. equities posted strong gains last week to kick off the third quarter after one of the worst first-half performances for financial markets in decades in which the S&P 500 tumbled 20% and the Bloomberg U.S. Aggregate Bond Index lost over 10%. For the week, the S&P 500 and Dow Jones climbed 1.9% and 0.8%, respectively, while the tech-heavy Nasdaq Composite soared 4.6% as market participants bought back into high-growth stocks that had been among the hardest hit in the first half of the year. Meanwhile, interest rates rose following a stronger than anticipated June employment report but remain well off their highs as inflation expectations have slid lower in recent weeks. The yield curve, a closely watched recession indicator, remains inverted with the yield on 2-year Treasuries trading higher than the 10-year equivalent, which has slipped below 3.0% in this week’s early trading.

One of the key focuses for investors in the second half of the year will be the rollover race between inflation and the labor market. If inflation shows clear signs of decelerating first before the employment picture sours, it would be a positive indication for markets as the Fed could ease off the brakes of aggressive tightening before more lasting economic damage is done, thereby achieving its “soft landing” objective. However, the central bank has made it clear that price stability has become the primary focus, and Fed officials will continue tightening until they are confident that inflation is contained, even if it means pushing unemployment higher to cool demand.

June’s job report indicated that the U.S. employment picture remains on firm footing with 372,000 jobs added during the month (compared to expectations for 275,000 new jobs) and the unemployment rate holding steady at 3.6%. Wage growth remains strong at 5.1% year-over-year but has moderated in recent months and continues to fall short of inflation. The rate of job growth is also cooling (the average monthly payroll gain was 474,000 in the first five months of the year), but this report gives the Fed no reason to deviate from its aggressive rate hike plan with a 0.75% increase expected this month, especially with demand for workers far outpacing supply. There are still over 1.9 job openings for every unemployed person.

More important to the trajectory of Fed rate hikes is the June CPI update that will be released on Wednesday. The report is expected to show a new cycle high 8.8% year-over-year increase in consumer prices. However, investors are also closely watching commodity markets where prices have broadly plummeted in recent weeks on concerns of slowing global demand. Despite sustained supply shortages from the conflict in Ukraine, the Bloomberg Agriculture and Energy Spot indices have tumbled 15% and 20% from their recent highs. Meanwhile, the price of copper, which is an important economic bellwether given its vast array of industrial uses, is now down 20% this year and at its lowest level since late 2020.

The week ahead is packed with potentially market-moving data releases headlined by inflation updates, the monthly retail sales report, and the beginning of second quarter corporate earnings announcements. Equity markets are likely to remain turbulent near-term as investors parse through the data and gauge the potential for reining in inflation without triggering a recession. Although the sell-off in the first half of 2022 has understandably rattled many investors, the sharp reset in valuations has brought the S&P 500 forward price to earnings ratio below its average since 2000 and has allowed bonds to regain some of their income characteristics for savers. It is also worth noting that the S&P 500 has only exceeded this year’s first-half loss twice since 1960 (in 1962 and 1970). In both instances, the index rallied back in the second half of the year with gains of 15% in 1962 and 27% in 1970.