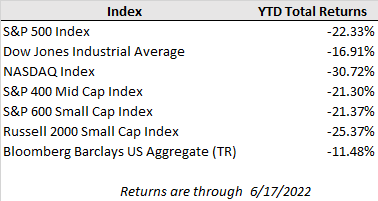

Global financial markets remained under pressure last week with U.S. equities broadly posting their sharpest weekly losses since the onset of the pandemic in March 2020. The week was headlined by the Federal Reserve meeting in which the central bank hiked short-term interest rates by 0.75%, the largest increase since 1994, in an increasingly aggressive shift in monetary policy to break the back of inflation. For the week, the S&P 500 tumbled 5.8%, while the Dow Jones and Nasdaq Composite each lost 4.8%, though the indices are regaining some of that ground in this week’s early trading as stocks bounce back from oversold conditions. Meanwhile, bond markets whipsawed on high interest rate volatility as the 10-year U.S. Treasury yield surged as high as 3.50% following the concerning May inflation report before sliding lower to close the week at 3.24% as market participants sought out safe-haven assets on concerns that tightening financial conditions too aggressively could tip the economy into recession.

The increase in rate hike expectations over the last few weeks has been dramatic. With last week’s rate hike, the short-term Federal Funds rate now sits above 1.50% and the market has priced in another 2.00% to 2.25% of rate increases over the remaining four Fed meetings this year, which is 1.00% higher than had been anticipated at the end of May, according to Bloomberg. Although regaining price stability has become the sole focus of the central bank, Fed Chairman Powell acknowledged in last week’s post-meeting press conference that “there’s a much bigger chance that [restoring price stability will] depend on factors that we don’t control” as supply disruption continues to have an outsized impact on the upside inflation pressures we are currently experiencing.

Geopolitical turmoil has complicated efforts to rein in inflation as more challenges have emerged to vital commodity production and distribution. Last week, Russia escalated the pressure on Europe in retaliation against Western sanctions by slashing crucial natural gas exports to the region. Flows from the Nord Stream pipeline, the primary carrier of natural gas from Russia to Germany, were roughly cut in half pushing up European natural gas prices by 51% last week alone. To blunt the impact of strained energy supply, Germany will restart coal-fired power plants and European officials are trying to incentivize companies and citizens to curb natural gas consumption.

In the week ahead, monetary policy will remain front and center as Jerome Powell is due to testify before Congress where he is expected to reiterate the need to combat inflation with an accelerated path to tightening. Investors will also continue to monitor the fallout of the shift in policy and financial market stress on other economic indicators including home sales, weekly jobless claims, and consumer sentiment, which are all on the docket this week..