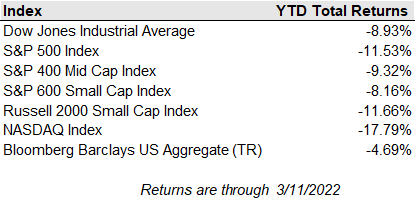

The Russia-Ukraine conflict paired with an inflation reading of 7.9% led to a selloff in the equity markets last week with the NASDAQ down 3.53%, the S&P 500 down 2.88%, and the Dow Jones Industrial Index down 1.99%. The Federal Reserve meets this Wednesday, with traders nearly certain that a 25-bps rate hike will be announced. The Fed's current thinking on the timing of additional rate hikes will be closely monitored. The Fed has a tough task of balancing inflation pressures with heightened geopolitical risks weighing on the global growth outlook.

Oil prices show signs of stabilizing. Brent crude, the international benchmark, fell below $109 a barrel today, its lowest level since the beginning of the war in Ukraine. Despite Russia’s small contribution to the world’s GDP, Russia supplies 11% of the world’s oil. The price of oil and other commodities remains historically high and will stay high unless we see a fall in demand or significant improvement in the relations between Russia and Ukraine.

Russia’s decision to repay some foreign creditors in rubles may not constitute a default on its debt, according to the industry group that oversees credit-default swaps. However, the IMF sees a Russian sovereign debt default as probable. Some US fund managers may be on the hook if Russia does indeed default on its debt, with PIMCO holding $1.1B in exposure to credit default swaps and Blackrock reporting a total loss of $17B across its funds. Additional contagion may follow.

While near-term volatility and uncertainty can be unnerving, proper asset allocation coupled with security selection are in place to ensure a prudent strategy in these turbulent times. If questions arise or you just want to talk, please reach out to your wealth advisor.