Inflation remains front and center on the minds of investors as last week’s inflation updates showed the rate of consumer price increases hit a multi-decade high in October. Concerns about sustained high inflation and a resulting back-up in interest rates knocked U.S. equities off a 5-week consecutive streak of gains. For the week, the S&P 500 slid 0.3% lower while the Dow Jones and Nasdaq Composite fell 0.6% and 0.7%, respectively. Meanwhile, the 10-year U.S. Treasury yield jumped back up to 1.58% from 1.45% in the week prior and the 2-year yield continues to drift higher as the market brings forward expected rate hikes from the Federal Reserve to rein in inflation. Markets have priced in an 84% probability of at least two rate hikes in 2022, which is up from 62% one month ago, according to the CME FedWatch Tool.

The October CPI release recorded a 0.9% increase in consumer prices for the month and a 6.2% increase over the past year, the highest mark since 1990. Energy prices, up 30% over the last 12 months, have been a significant driver of the high headline numbers, but core CPI (excluding food and energy prices) still registered a 4.6% year-over-year increase. A surge in demand for goods in the lead-up to the holiday season has exacerbated rising pricing pressures from a still struggling global supply chain.

While U.S. consumers broadly continue to benefit from healthy balance sheets and improving employment and wage growth prospects, they are feeling the pain from the sustained push higher in consumer prices. In fact, last week’s survey from the University of Michigan showed consumer sentiment falling to its lowest level in decade, even below the level hit in the depths of pandemic lockdowns in April 2020. One quarter of survey respondents cited inflationary reductions in their living standards, with the greatest impact being felt by lower income and older consumers.

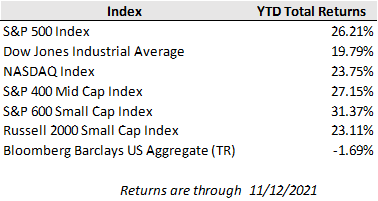

Corporations are also increasingly citing the impacts of rising prices, though you won’t find much pain looking at corporate profits from the third quarter corporate earnings season. According to FactSet, 285 S&P 500 companies mentioned "inflation" on their Q3 conference calls, the highest going back to at least 2010. However, nearly two out of three S&P 500 companies reported better profit margins than they did before the pandemic, reflecting the strong demand environment and pricing power to pass on cost increases. Overall, the S&P 500 is on track for 41% growth in earnings per share in aggregate for the third quarter compared to a year ago. Those robust corporate profits have in turn helped to push equity markets higher this year and to provide protection against the eroding power of inflation for investors.

In the week ahead, consumer spending will be in focus as we move into the holiday season with U.S. retail sales released this morning and several large retailers on the docket to report earnings. U.S. retail sales grew 1.7% in October, well exceeding expectations for a 1.1% increase. The strong report indicates that U.S. consumers overall haven’t yet been deterred from increasing spending by rising prices and supply and labor shortages. Market participants will also be keeping a close eye on Covid trends as new U.S. cases have inflected higher with the colder weather increasing indoor gatherings.