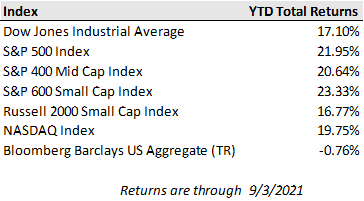

Once again, bad news was received as good news for equity markets last week as major U.S. indices continued their push higher despite an August employment report that fell well short of expectations. The rationale is that weak economic data, particularly regarding the recovering labor market, puts less pressure on the Federal Reserve to begin its plans to reduce accommodative monetary policy that has been a notable tailwind for markets. Stock markets, aided by excess liquidity and few attractive alternatives with bond yields so low, have managed to climb a wall of worry in recent weeks highlighted by Covid variants, turmoil in Afghanistan, lingering supply chain issues, and fading stimulus. For the week, the S&P 500 and Nasdaq Composite edged higher by 0.6% and 1.6%, respectively, while the Dow Jones ended -0.1% lower.

The U.S. labor market recovery cooled off notably in August as rising delta variant cases weighed on hiring. Nonfarm payrolls rose by just 235k for the month compared to July’s gain of over 1 million and for expectations of around 750k. The service sector in particular showed the greatest slowdown as leisure & hospitality employment was unchanged during August after gaining 350k per month on average going back to February. However, some of that weakness may also be attributed to seasonal factors as peak summer service demand moderates. The jobs report also showed the unemployment rate ticking down to 5.2% and wage inflation rising further than expected with average hourly earnings up 4.3% year-over-year versus the consensus forecast of 3.9%.

With inflation running hot, employment will remain the key factor in the Fed’s determination to taper bond purchases with September’s jobs report being especially significant as federal enhanced unemployment benefits officially ended after Labor Day. With the expiration, over 9 million Americans who are not covered by traditional unemployment insurance (including 5 million gig economy workers) lost their pandemic unemployment benefits. Additionally, 3.9 million Americans will no longer receive the $300 weekly supplement to other unemployment benefits.

The week ahead will be a relatively quiet one from an economic data perspective except for an update on job openings and the Producer Price Index (PPI), which is forecast to have risen to 8.3% year-over-year from 7.8% last month. Market participants will also be watching what is shaping up to be a busy September in Congress as lawmakers discuss stimulus and the federal debt ceiling. The House is expected to vote on the $1 trillion bipartisan infrastructure bill by September 27th, though much of the attention will remain on the negotiations around Democrat’s $3.5 trillion stimulus proposal, which is still being formed, and its potential tax implications.