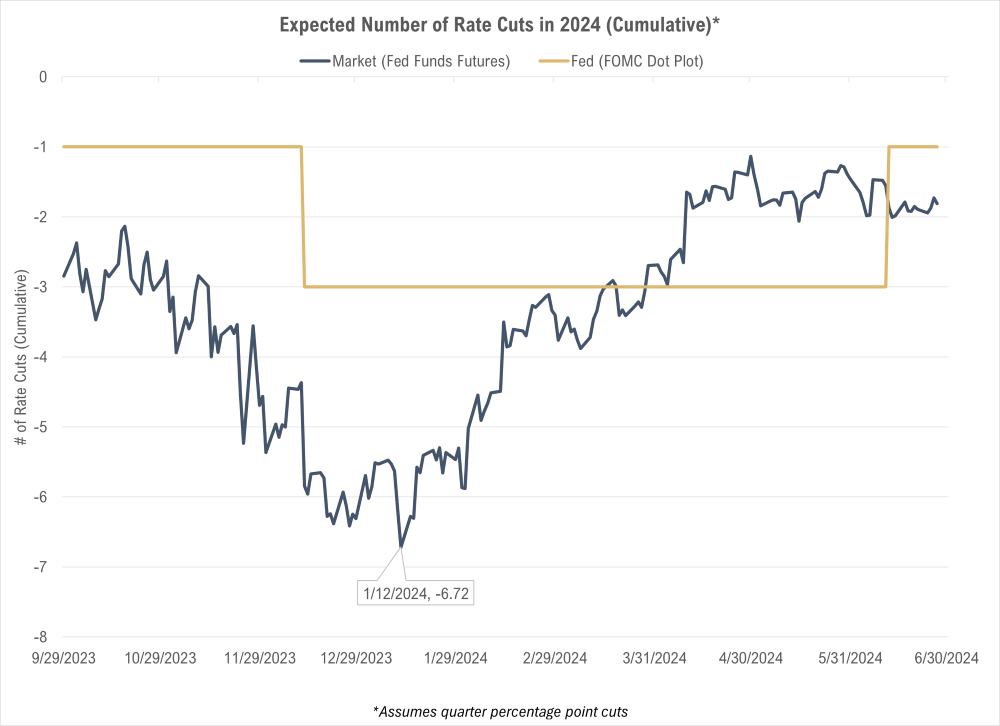

Interest rate cuts were top of mind for market watchers entering 2024. After an aggressive rate hike cycle that saw eleven hikes over a 16-month period from March 2022 to July 2023, the Fed Funds futures began the year pointing to the possibility of as many as seven rate cuts in 2024. The inflation rate was in the spotlight, and if the data continued to show the rate falling back toward the Federal Reserve’s target of 2%, the prospects for multiple rate cuts looked good. However, what unfolded over the first half of the year wasn’t exactly as forecasted. As the monthly inflation numbers rolled in, a concerning trend began to show. The December inflation number was higher than expected, followed by the January inflation number coming in above expectations, then the February number, and the March number. By the time of the March Fed meeting, it was clear that inflation was proving more stubborn than originally thought, and the March Fed meeting came and went without a rate cut.

Both the stock and bond markets adjusted quickly to the prospect of “higher for longer”

interest rates. Stocks declined for several weeks in April and bond yields moved higher as the markets prepared for an extended period of higher rates. Other indicators also signaled there was not an immediate need for rate cuts. The unemployment

picture remained strong, with the national unemployment rate at 4% or below. Consumer spending also remained robust, supporting the notion that rate cuts weren’t necessary to stimulate the economy. Fed Chairman Jerome Powell even stated in late

March: “This doesn’t feel like an economy that is suffering from the current level of rates.” The inflation data improved in April and May, coming in at or below expectations. The Federal Reserve stuck with the wait and see approach

at the June meeting, again electing not to cut rates but pledging to continue to watch inflation, employment, and other economic indicators for signs of economic stress. We reached the half-way point of the year with no rate cuts and both the futures

market and the Federal Reserve dot plot forecasting just one rate cut for the year, most likely in September.

Both the stock and bond markets adjusted quickly to the prospect of “higher for longer”

interest rates. Stocks declined for several weeks in April and bond yields moved higher as the markets prepared for an extended period of higher rates. Other indicators also signaled there was not an immediate need for rate cuts. The unemployment

picture remained strong, with the national unemployment rate at 4% or below. Consumer spending also remained robust, supporting the notion that rate cuts weren’t necessary to stimulate the economy. Fed Chairman Jerome Powell even stated in late

March: “This doesn’t feel like an economy that is suffering from the current level of rates.” The inflation data improved in April and May, coming in at or below expectations. The Federal Reserve stuck with the wait and see approach

at the June meeting, again electing not to cut rates but pledging to continue to watch inflation, employment, and other economic indicators for signs of economic stress. We reached the half-way point of the year with no rate cuts and both the futures

market and the Federal Reserve dot plot forecasting just one rate cut for the year, most likely in September.

Save for the brief interruption in April to digest the absence of a rate cut, the stock market advanced steadily through the first half of the year. Led once again by very strong returns from a small group of stocks, the S&P 500 had a total return of 15.3% through the first half of the year. The narrow breadth was a continuation of a trend that emerged in 2023, when seven leading stocks were given the name Magnificent 7 or “Mag 7.” Comprised primarily of technology companies, these seven stocks (Alphabet, Amazon, Apple, Microsoft, Meta, Nvidia, Tesla) have collectively advanced by more than 110% from the end of 2022 through May 2024. Over the same period, the S&P 500 as a whole has returned approximately 38% excluding dividends. It would be an understatement to say that the contribution of the Mag 7 stocks has been significant. If you include Broadcom and Eli Lilly in the mix in place of Tesla, those 8 stocks represent 73% of the return for the entire S&P 500 index so far in 2024. The excitement surrounding Artificial Intelligence (AI) has been a catalyst behind the success of the Mag 7 as investors jostle for position in what they hope to be the early innings of the next technological revolution. Specifically, the largest stock gains have come from companies whose products include microchips used in AI applications, like Nvidia and Broadcom who both recently announced 10-for-1 stocks splits to make their share price more affordable to the masses. As the AI revolution gains momentum, other large tech companies like Apple, Microsoft and Amazon rely on these chips to power their products and services.

Taking a deeper dive into the success of these stocks leads to some interesting observations. Most notably, the headline grabbing returns of the Mag 7 could very well be masking the reality of challenges across the rest of the market. In fact, the earnings growth for the S&P 500 excluding the Mag 7 has been negative for 5 straight quarters. All of the earnings growth for the S&P 500 in 2023 came from the Mag 7. Just two industry sectors, Technology and Communication Services, have contributed 72% of the overall return for the S&P 500 so far in 2024. This is in contrast to 2022 when the Mag 7 stocks detracted from earnings growth and returns of the overall market. Forecasts show the gap in earnings growth between the Mag 7 and the rest of the S&P 500 is expected to narrow in the quarters ahead, but it definitely bears watching.

Politics will take center stage in the second half of the year, leading up to the US Presidential election on November 5th. While a Democrat sweep looks unlikely at this point, a Republican sweep is not out of the realm of possibility. The combination of increased support for former President Trump after the failed assassination attempt, Democrat voters who may be not comfortable voting for Vice President Harris as a late replacement for President Biden on the ticket, and a Senate class that includes many more vulnerable Democrat than Republican seats, could produce a Republican president and GOP control of both houses of Congress. The most likely outcome, however, is a split government with no single party control over all three pillars. A divided government is becoming more common, with the US not experiencing consecutive presidential terms with all three pillars under one party since 2007. In the 20th century, a party held the House for 12 years on average and the Senate for 8.5 years on average after winning a majority. This century, that number has fallen to 4.8 years in both chambers. Both parties are responsible for adding to the nation’s growing debt burden; Republicans through tax cuts and pandemic stimulus, and Democrats through continued post-COVID deficit spending. Specifically, as it relates to the budget deficit and national debt, a divided government may be the best-case scenario. Worldwide, this is a record-breaking year for elections as more than two billion voters in 50 countries will be heading to the polls, potentially bringing dramatic change to the global political landscape.

There is no shortage of themes to watch in the second half of the year. In recent years, geopolitical risks appear to be getting hotter, rather than cooler. Greater uncertainty surrounding the future path of policy leading up to the election may contribute to increased market volatility, especially given current market valuations. We have come to expect at least one “October Surprise” in election years. Labor markets deserve attention, as large-scale layoffs and rising unemployment often signal a coming recession. The inflation numbers will be closely watched as well, with strong demand for services and housing leading to sticky inflation so far. Cracks in the housing market, signified by pullback in housing demand and falling home prices, would be another recession signal.

While the long-held belief is that the stock market likes lower interest rates, the reality is that a Federal Reserve that is lowering rates, and even more so one that is aggressively lowering rates, means that the economy has stalled or slowed enough that it needs stimulating. Since the market is constantly forward-looking, often the best returns come while anticipating lower interest rates, as we have seen over the past year. By the time the actual rate cuts occur, whatever the reason for the cuts may be enough to dampen market enthusiasm. No matter the circumstances, as always, your team at First Merchants Private Wealth Advisors will be monitoring the situation closely, providing advice, and positioning your investments to give you the best possible chance for success.