Asset Based Lending (ABL) Solutions

Asset Based Lending Group

Our First Merchants Bank asset based lending programs can be the optimal financing solution, compared to cash flow loan structures, for companies in many different circumstances.

A Comprehensive Asset Based Product Suite

- Formula-based loans for a broad leverage continuum, including elevated cash flow leverage and turnarounds

- “Stretch” loans for “under-secured” borrowing to clients with earning/cash flow predictability to support

- Asset based lending loans from $5 million to $75 million; may participate above $25 million

- Competitive working capital and fixed asset advance rates to optimize availability

- Underwriting emphasis on collateral over cash flow leverage and fixed charge coverage

- Fewer, more flexible financial covenants than traditional loan structures

Tailored to Your Needs

Asset based lending works seamlessly with your First Merchants banker to align solutions to meet your needs, based on your circumstances. Are you experiencing challenges with debt service coverage permitting a traditional loan structure? Do you need to access additional borrowing capacity based on assets? Does growth, working capital intensity or a turnaround plan make it critical to maximize liquidity based on working capital assets? Do you need flexible financial covenants, enabled through a formulaic asset based approach? If so, we may be the right fit for you. Asset-based lending discipline also improves credit profile and pricing.

ABL and Economic Uncertainty

In this economic environment, there is increased demand for asset based lending solutions. Asset based lending can provide companies more predictable borrowing availability and relief from financial covenants. This allows clients to navigate revenue and margin compression associated with economic downturns and increased uncertainty. Availability under an asset based lending loan is governed by your assets, not cash flows, which provides more certainty in challenging times. Also, since collateral is monitored, financial covenants are more flexible.

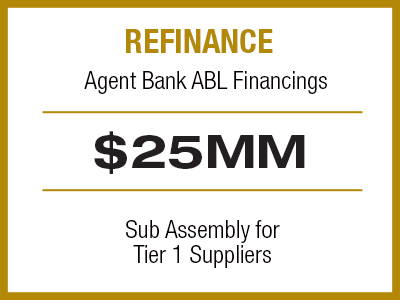

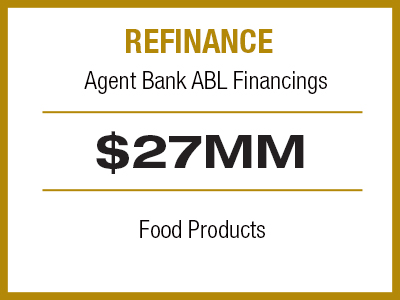

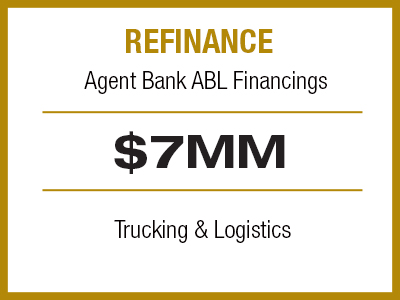

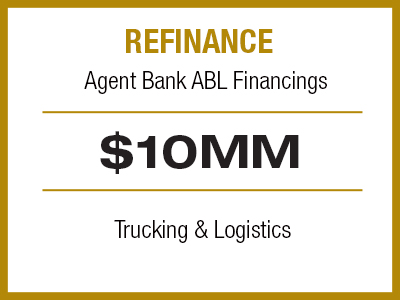

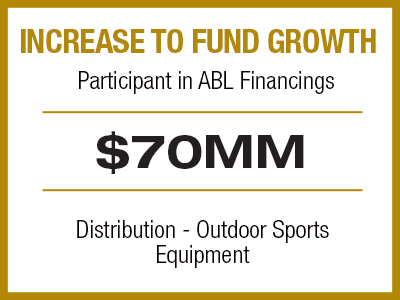

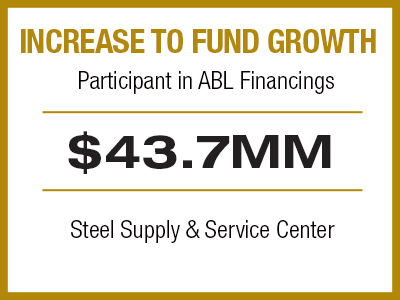

Examples of How We Can Help

We’re ready to help. To get started today, contact:

Mike Kroger

317.706.6658

[email protected]

Ted Parker

317.566.7690

[email protected]

Jake Sklena

847.767.4301

[email protected]

FAQs